Selection of stocks for day trading is a critical part of developing one or several day trading strategies. It is important to make this selection based on type of intraday strategy that you want to use

What are best day trading stocks?

There are several common criteria that any of best day trading stocks should have. Only stocks with these parameters could be considered if you want to develop profitable intra-day strategies.

Best day trading stocks have good average trading volume

The first critical parameter for a best stock to intraday trade is liquidity. A stock should offer enough liquidity i.e. intraday volume. This condition is critical as it has direct impact to risk and money management process for every day-trader.

It is good to have high average daily volume for these stocks. But not all high-volume stocks are good for day traders.

There are also high volume stocks that do not move enough during market hours. Such tickers should be avoided.

You can see that GE stock is a high-volume stock but its daily price range is not good for intraday strategies.

You can compare it with KLAC stock. This stock also has high volume but its price range during regular stock exchange hours is much higher.

I recommend selecting tickers with 1 million average daily volume.

LET’S TRADE THE SMART AND SIMPLE WAY

Enter your name and email to get Instant Access to my FREE tips to get you started on the right path and of course to my regular newsletter with stock picks and attractive ETFs

Best stocks for day trading have good price range

And so I described the second important condition for best day trading stocks. As I wrote above these tickers should be able to do good intraday moves. This parameter is often called volatility. But these days (10/2011) the volatility of the stock market is quite high for a majority of stocks. So it is good to check volatility of any such stock over longer period of time.

It is known that shares that are traded on the Nasdaq stock market are more volatile than NYSE listed shares. So it is possible to start with Nasdaq listed companies when searching for good shares for intraday strategies.

Best day trading stocks price

The price of stocks for day trading is another parameter that should be considered in the selection process.

A lot of intra-day traders that start with smaller accounts think that it is better to trade low priced stocks. They tend to select tickers with price in the range from (under) 1 USD to 5 USD.

This is not a good way. These tickers are known as penny stocks and I must warn everybody who wants to trade them. Trading these shares is extremely risky. It is not possible to manage risk when trading these shares. A lot of traders cleared their accounts by trading these penny stocks.

I would recommend thinking about stocks priced above 20USD. 20USD is a minimum, better would be to find above 30USD. These shares could offer quite good intraday price range and it means also good and profitable opportunities for intraday strategies

The final question I would like to discuss here are tickers with high prices. If you apply parameters described above you will also find several shares with price north of 100USD.

A typical daytrader could consider that day trading a stock with a price above 100 or 150USD could be very risky. Especially if his/her trading account is not big enough.

I would like to tell you that it is not so risky to day trade tickers with such share prices. It is possible to buy a small amount of

shares for each day trade. Best brokers offer the possibility to buy one or a few shares (5 or 10 shares). So the risk can also be managed well with these highly priced stocks.

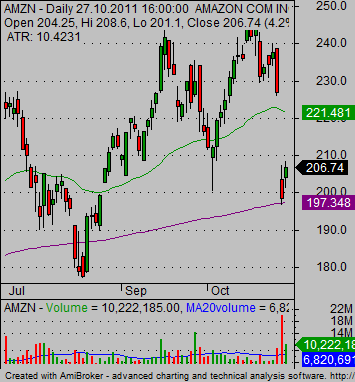

Good examples of best day trading stocks with price above 100 USD are tickers like AAPL, AMZN, GOOG. Here are their charts.

AAPL is a stock that has a big impact to total Nasdaq stock market sentiment, so I monitor AAPL quotes regularly.

Find more on related pages

- Ideas for a screener for daytraders

- Ideas to create profitable day trading system

- More about intra-day strategies