Invest in silver ETF or trade ETF silver shares. Both can generate nice profits for your portfolio. But I recommend being an active investor. Do not hold this commodity ETF for the long term. You can be very disappointed by the results.

Why to invest in silver?

This is a metal with two features. It is an industrial metal. But it is also one of the precious metals.

It therefore reacts positively to economic expansion. When the global economy is rising, when manufacturing is going up, then silver is also in demand.

The second reason is that with the current state (2011) of economies in developed countries like USA or Europe, we see easing of interest rate policies and also money printing. These tactics used by big central banks in the developed world shake the confidence of investors in fiat currencies like the US dollar. And a lot of investors are using precious metals as an alternative to paper currencies.

These reasons create strong trends in the price of this metal. These trends can be used by active investors or traders and can generate nice profits in their portfolios.

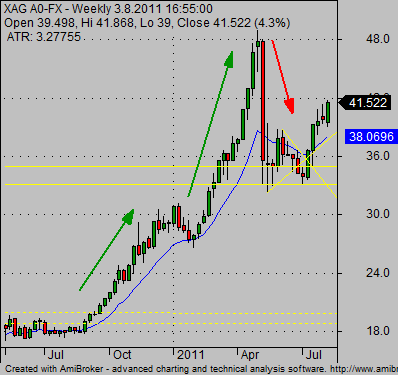

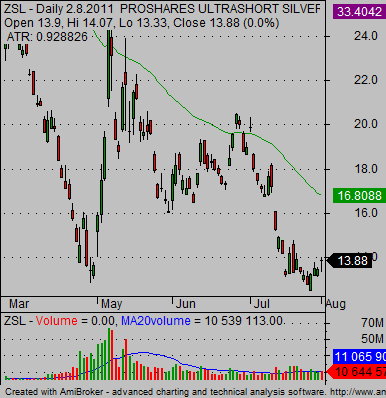

It is important to know that it is possible that the trend will not only be up, but also down. Both trends – uptrend and downtrend – could be very big moves. Just notice this chart below.

This metal is typically priced in USD, but it is also possible to trade it in other currencies. If we will see something positive from the US government, then USD can rebound. In such a case the price of silver in USD will decline. It is possible to buy this metal in another currency (like EUR or GBP or JPY) if you have a good stock broker.

Silver ETF List

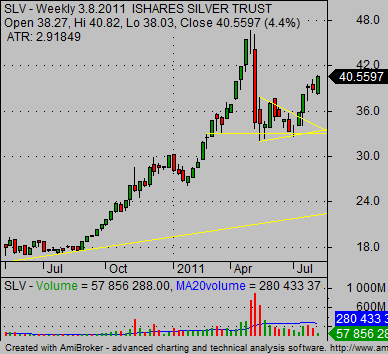

The most popular silver ETF is SLV. This exchange traded fund tracks the price of the physical metal. As you can see on the chart below, the stock chart of SLV is similar to the cash chart above.

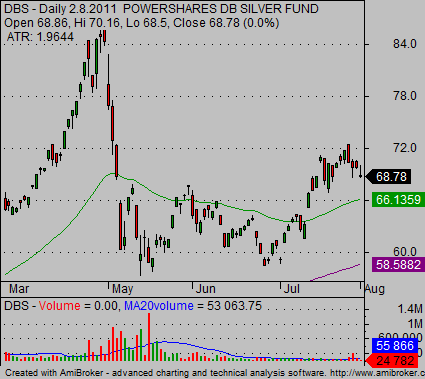

But SLV is not the only option to invest in silver. Traders could also use shares of DBS for their exchange traded fund trading strategies. This exchange traded fund is not leveraged either.

Trading silver using leveraged ETF

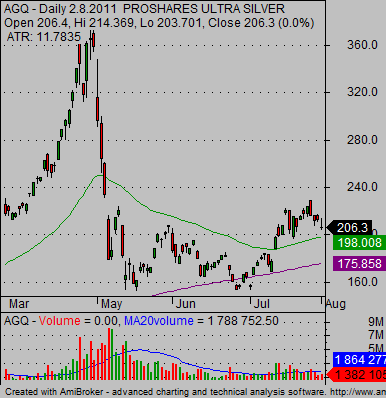

Some day-traders could prefer to use leveraged ETF shares for trading silver. I have mentioned several times that leveraged exchange traded fund shares are not good for long-term holding. These twice leveraged shares are best for day-traders or very short-term traders. If you are a position trader or active investor, use the standard silver ETF shares mentioned above for long and short selling strategies.

AGQ Ultra Long exchange traded fund

ZSL Ultra Short exchange traded fund

Silver miners ETF

One very specific option is to trade the sector of silver mining companies. It is possible to select best silver stocks by using your own analysis or simply use the silver miners exchange traded fund with symbol SIL. This exchange traded fund is not directly exposed to the price of silver.

Find more on related pages

- Check these ways to spot alternative energy etf opportunities

- Learn to use also Palladium and Platinum ETF

- Keep reading about commodity ETFs