You should start writing a trading plan as soon as you decide to make any activity on stock markets. It is like with any other business. You have to prepare plan in advance to know what you should know, what you have prepared before you can start these activities.

You should also define your goals that you want to achieve with this stock trading business. Process of writing a trading plan should clarify every issue that is not clear at the beginning or appear during writing a trading plan.

Major points for a stock market trading plan template

The stock trading plan is really a business plan for your trading business. It should cover many issues but generally it can be divided into these main sections:

Your beliefs and expectations

What do you think about markets, economy, the world generally.

What do you want to achieve, what are your final targets. It can be monetary issue like “I make 6 figures profit per year” or something more lifestyle related “I want to work 3 days a week only and live in Caribbean’s “

Your financial situation and expectation

What is your current financial situation? What financial goals you have to reach if you want to achieve goals defined in previous section.

Your rules for management of emotions

Emotions play important role in everyday decision making of any human. The wealthiest people know how to control their emotions and make right decisions. You will be making money and losing money with stock trading activities regularly so control of your emotions is a big issue. It could be one of most important parts of any stock trading business plan.

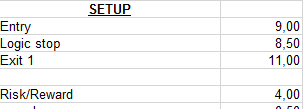

Your rules for risk and money management

Stock trading is about using money. Every decision leads to making or losing some amount of money. You can make money only if you are able to take risk. But risk must be controlled and its amount calculated in advance.

Stock trading is not a gambling. It is based on probabilities. It is not necessary to make more than 50% or profitable trades to have nice income.

Risk Excel sheet

There are stock traders that make only 40% of profitable trades. But they excel in controlling the risk and losses. So they make huge amount of money regardless of the amount of losing trades.

Description and list of all strategies you actively use

Your stock market system should consist of several different strategies. If can be difference in a style – you can have some swing trading strategies together with daytrading strategies or you can prefer to combine it with less active position trades.

Strategy example

Another approach could differentiate strategies with trend. There are trend based strategies like breakout or pullback based strategies. Another option is to have range strategies or reversal strategies used in less trending markets.

Rules for regular review of you systems

You cannot miss rules for reviewing when writing a trading plan. Nothing is constant and stock markets evolve all the time. So you have to check regularly if your rules are still applicable or if they need some modification.

It is also possible to have several set of rules for different situations.

Find more on related pages

- Do you want to know how do I buy stocks?

- Find the most popular Inverse ETF shares

- Gather more tips to prepare profitable stock trading system