“What are ETF?” “What are exchange traded funds ?” I hear these questions from time to time when people find that I use these exchange traded funds a lot in my trading strategies. I like them as very nice option for short term swing trades but also for mid term position trades.

Exchange traded funds (ETF) are index funds or trusts that are listed on a stock exchange. These funds happened to be very popular vehicles that a lot of traders or active investors are using these days.

What are ETF – exchange traded funds

Here is simple reply to question what are ETF.

They are securities that track an index, a commodity or a basket of assets like an index fund, but trades like a stock on an exchange. Exchange traded funds experience price changes throughout the day as they are bought and sold.

Shares of such exchange traded funds can be easily bought and sold during trading day on stock exchanges. Most actively traded exchange traded funds are listed on US stock exchanges although there is quite big list available also on Xetra – German stock exchange.

The biggest provider of these ETFs in US is Ishares. Ishares ETFs are large group of funds that track several different indexes – broad-based, sector-based, international, or bonds or even commodities or currencies.

ETFs are very popular now because they offer a good choice for trading several markets very easily. It’s now possible to buy “index ETF” and participate on the performance of this index. A trader need not buy every stock in the index in predefined amounts; he can easily buy index-based ETFs!

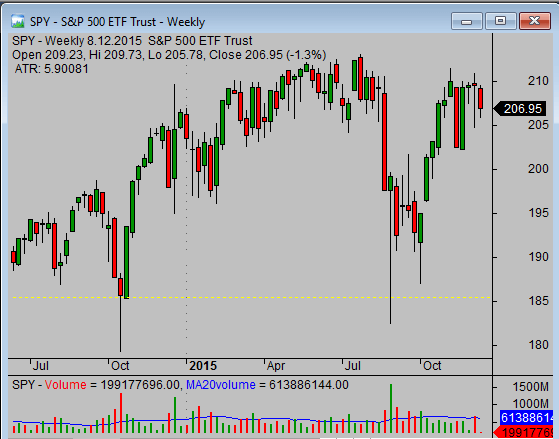

SPY ETF chart

ETFs have also several others advantages:

- no problem with liquidity

There’s no problem with liquidity of ETF stock. Bid and ask are always calculated from prices of underlying stocks. So it isn’t necessary to have good trading volume in ETF.

- reduced risk

Individual stocks can make wild swings sometimes. Important news can move the price of individual stock down rapidly. Not in ETF. Every individual stock is only part of a basket of ETF stocks, so a move in one stock will not produce a huge move in ETF share value.

There are several companies issuing ETF shares. It is up to every trader which one will be used for trading.

Best options for active investors and traders

If you have your answer to question what are ETF shares I would like to provide you another important advice. These exchange traded funds are really good option and substitution to mutual index funds. Every investor should consider to replace mutual funds with these exchange traded funds.

These ETFs are also one of the best options for equity traders. There is possible to trade them during a day in daytrading strategies. I prefer to hold trades opened little bit longer and ETF are one of the best options how to do swing trades or position trades with sectors, indexes or how to trade commodities and currencies.