I placed the Uranium ETF into my list of commodity ETF shares I track at the beginning of 2011.

Uranium is very important for the nuclear energy industry and power stations. Nuclear power stations are big sources of electric power around the world. Uranium has some risks, as we can see from several big damages in history (Chernobyl disaster 1986 in Russia or Fukushima 2011 in Japan).

But it has a very important place in power generation as there are not many alternatives. It is also quite cheap type of power generation. And uranium is an essential source for them.

I personally see uranium and nuclear power generation as positive for our world and energy needs. It is a very good global macro investing idea and I like to use it for position trades I place into my portfolio from time to time.

Uranium etf securities

Active investors can find two important exchange traded funds which can be used for this idea based on uranium.

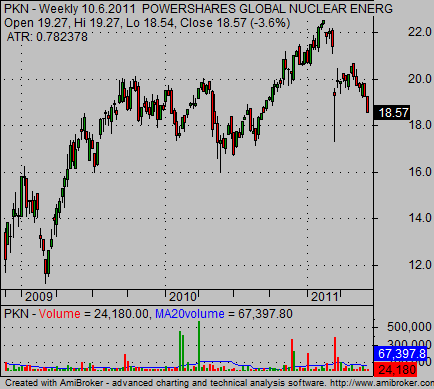

PowerShares Global Nuclear Energy Portfolio (Fund) with symbol PKN tracks the WNA Nuclear Energy Index (Index). This index aims to measure the Global Nuclear Energy industry. It includes companies whose engagement in the nuclear energy industry may have a material impact on their overall performance. It is not directly exposed to the price of this commodity.

Another opportunity in the arena of commodity ETFs is URA. It is a Global X commodity ETF. It tracks the price movements in shares of companies which are active in the Uranium mining industry. So it could be more exposed to the price of this commodity.

All commodity ETFs mentioned here could be traded on a technical basis as I do in my ETF Trading strategies. I have both of these commodity exchange traded funds on my list of ETF securities I analyze and trade regularly. It is also possible to implement some global macro research. I use a similar approach for my position trades portfolio. The best way is to combine both methods – technical and fundamental overview.

Find more on related pages

- Read also about water ETF

- Understand steps for perfect gold trade

- Find more about commodity ETF trading