Stock market timeline for good trades is a full list of steps and rules that must be done to reach an expected goal. This goal is almost always defined as profit. But the goals for a good online trading system are more broad. The most important task that must be accomplished is to set up rules that are followed in every trade or in investments.

Here below I would like to describe a stock market timeline with steps that have to be included in every good system. I think that these basics of investing and trading should be used if you want to achieve good results , i.e. generate profit.

Most of these rules are well suited for swing or position traders and active investors. Daytrading systems should use a little bit different stock market timeline with a set of steps that is most suitable for a daytrader.

Analyze current stock market situation

The start of a timeline is defined by analysis of a broad stock market situation. It is important knowledge. We do not want to be bullish and open many bullish positions if the situation is negative. And also you have to plan what stocks to buy if current mood is bullish.

Select appropriate strategies for current market situation

The market is not always in one mode. There are many different states of market situation. Today’s mood could be bullish but a week later we could be neutral or in a bearish situation.

You have to prepare different strategies for these different market types. What trades do you plan to execute in a bull market? What is your preferred online investment strategy for a strong and volatile bear market situation?

Select and run screener that fits best to selected strategies

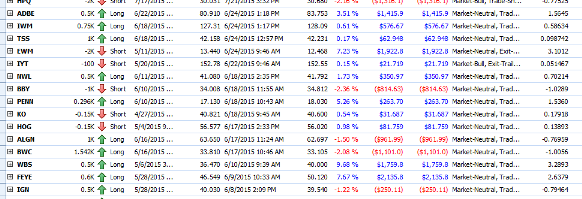

As a next step in our stock market timeline we have to select what are best set of parameters for best stock pick in todays situation.

The list of possible candidates for best buy or sell stocks will appear after running an ideal market screener. The list is always bigger than just a few single candidates so you have to go manually through these picks or use additional filtering rules for further specification of best candidates.

market scan results example

Create trade setup for best buy, sell stocks

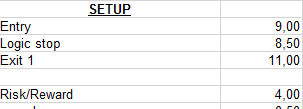

Now you have to prepare a complete setup for a trade with any of these tickers. The complete setup will define whether your entry, stop loss and target levels comply with your risk management rules. This step in your timeline could eliminate some candidates.

risk reward ratio excel sheet sample

Put ticker list into your execution software

Now you have to put the list of tickers that are prepared for trade into your broker software. If you monitor live stock quotes manually, you can spot the time for execution. But I recommend setting up some alerts in your software and waiting for their notification.

Enter and manage your trades

When you are notified about reaching the trigger price you have to execute orders to enter the trade. Immediately after the position is opened you have to use some position management rules that define how to set up a stop loss order and how to monitor realtime quotes.These rules rules help in this task until the end of the trade is reached.

Execute closing orders correctly

Your trade management rules will tell you when to close your position. It can be some form of stop loss order execution. Or you can manually send limit order for your profit taking action.

Write details about trade to stock trading journal

When your trades are finished then it is time to use another tool – journal of your trades. Put all details about every one of your trades into a journal software. This is important step for a timeline. It will help you to check and see if you followed your rules in every single trade and this routine should help to avoid most trading mistakes you can do.

trading journal software example

Evaluate your trades

This is the last step in the stock market timeline for best stock trades. At the end of the day, week or month you have to go through your list of trades that you have now in your journal.

It is time to evaluate whether or not you followed your timeline and rules defined in your business plan and your market system. Check if you made some mistakes and try to find a reason why. If you find some idea why you did it then you can also find a way to avoid these trading mistakes next time.

This evaluation will lead to improvement of your online stock trading and investing activities.

Find more on related pages

- Gather trading know-how from this TCO selling stock short trade example

- Read how to analyze and trade Dow Jones utility average

- Learn more tips for profitable stock trading