One recommended way to invest money is to find stock market picks that are showing relative strength. Why?

Shares with relative strength show signs of strong accumulation by institutional investors. These investors need to place huge amounts of money so their buying can move the share price up. And you can use these price movements for profitable trades.

This movement then defines relative strength of particular ticker or whole sector that we can use for our profitable stock strategies. These picks are ideal candidates for a swing trades or for position trades. But active investors can use them also as an investment picks that could be held for months.

Identify strong part of broad market using analysis of stock market indexes

The best way is to divide U.S. markets and exchanges into two categories.

- Technology sectors – they’re related to the NASDAQ market index

- Other more classic sectors – they’re related to the S&P 500 market index

During this first step you must evaluate which part of the market is stronger than another. This can be done simply by comparing charts of these main market indexes.

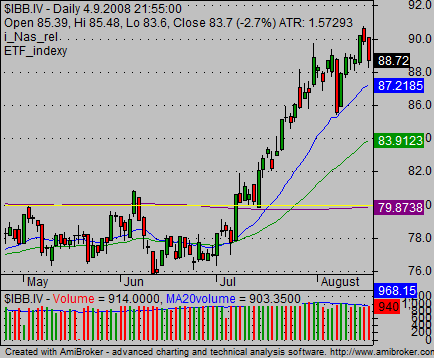

The best way is to have both charts on the screen together and compare them visually. Here’s an example of how these charts can be compared.

Find strong stock market sectors in this part of the broad market

It’s necessary to look at sector charts. You can do it using ETF securities that represent individual sectors traded on the market.

And here’s an example of comparing of two sectors in the technology area.

The logical conclusion is that best picks to buy for a long trade during that time period was in biotechnology sector.

Find more on related pages

- Check market situation when screening for profitable stock picks

- How to look for momentum hot stock picks

- Keep reading further about technical chart analysis