Gold bullion securities are one of the recent additions to a popular group of commodity exchange traded funds. Trading commodities and precious metals especially has been quite popular over the last years. Investors pushed prices of ETFs like GLD etf up as they have been afraid of debasement of USD as a major world currency.

What are gold bullion securities

This first European gold ETF/ETC was created in 2003. These bullion securities are designed to offer investors a simple, cost-efficient and secure way to access the physical gold market. GBS bullion securities is intended to provide investors with a return equivalent to movements in the gold spot price less fees. The ticker for Gold Bullion Securities is GBS and these shares are traded on the London Stock exchange.

There are also further commodity exchange traded funds that allow you to track and participate on prices of real gold metal. There are ETFS Physical Gold with symbol PHAU or ETFS Physical Swiss Gold with ticker SGBS, both traded on the London stock exchange.

What is their major difference from other gold related commodity exchange traded funds? Well, these bullion securities mentioned above are backed by holding of real physical metal in secure vaults. It could be positive information if this ETF is used for long-term holdings by some investor. This advantage is not so big if you plan to be more active investor or trader with gold-related exchange traded funds.

How to trade gold etfs and other commodity exchange traded funds

There are several different strategies that can be used for trades with precious metals ETFs. They can be based on fundamental analysis, technical analysis or a combination of both. I will leave fundamental analysis to you and now I would like to discuss more technical aspects of possible ETF trading strategies.

The first important issue that should be resolved is the selection of the best precious metals ETF for your strategy. You can use gold bullion securities or other gold funds backed by real gold holdings. Another option is to use other popular gold precious metal exchange traded funds like GLD ETF or iShares ticker IAU that tracks gold futures on commodity futures exchanges in the USA. Although some traders also prefer to trade some gold stocks of gold mining companies.

Check bigger picture

It is always good to check the bigger picture. What is the current situation with gold? Is it in some long-term up-trend? What is the current short-term trend? And what is the general situation on the precious metals market? And finally what is the opinion of investors about commodities?

These questions should be answered before any gold investment decision. Although decade since the year 2000 was very bullish for precious metals, this is not a common situation. There were periods when these metals were in bear trends.

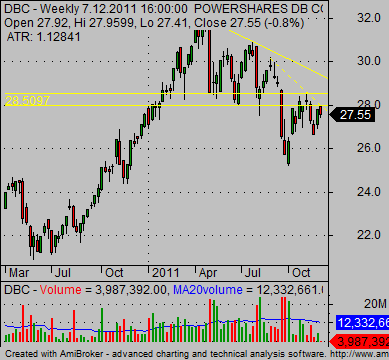

How to check the global commodity situation? Use this broad commodity ETF with symbol DBC.

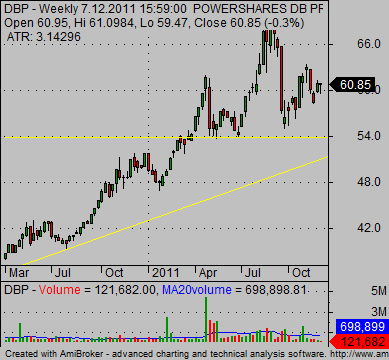

It is also good to check what is the opinion of investors about precious metals as commodity sub-group. It is possible to use DBP as a related commodity exchange traded fund.

And finally it is time for stock chart reading of some exchange traded fund like GLD ETF or the above mentioned physically backed funds – bullion securities.

Select the best etf strategy

Now a trader or investor should do further steps based on stock chart reading of the above-mentioned charts. A major decision should be made what type of strategy could be best for an actual situation. This decision is also based on the type of stock trading that is applied by every individual investor or trader.

It should be decided if we are going to prefer a bullish strategy or bearish strategy to trade these bullion securities. It is quite easy to buy these gold shares and the best stock brokers also offer the easy possibility to sell short these gold ETFs. So it is really no problem to participate in bullish or bearish trends in these bullion securities.

Next it is possible to go into more details and check if it is possible to find some trading strategy setup or if bullion securities should be monitored more to wait for a more compelling setup with best risk reward parameters.

Find more on related pages

- Inspire by this list of the best gold stocks, gold miners & gold etf

- Tips for learning how to invest in silver

- Gather further details about Commodity ETFs