I started to develop ETF Trading strategies during first years of my stock trading education. It was almost 10 years ago. There were not so many exchange traded funds available back then. The most popular exchange traded fund were index etfs like QQQQ and SPY. Sector trading strategies using sector etfs were not so widely used like today.

I choose exchange traded funds as my main trading vehicle as I liked how they acted in accordance to technical analysis I used for stock chart reading.

I’ve used this strategy for etf securities trading for several years already, and this is my core exchange traded funds strategy. I personally trade several different strategies in my portfolio as I try to use best one for every stock market situation.

Based on my experience, strategies for ETFs could generate nice regular income. This kind of system for traders isn’t as volatile as classic stocks only based systems, but there is huge liquidity. So a trader can easily increase its position size.

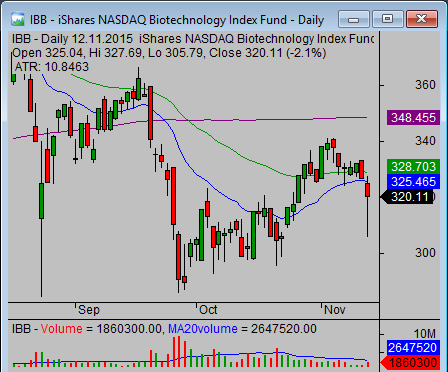

Candlestick chart for my ETF trading

Key points for the best trading performance

This strategy is based on these basic premises:

- it is based only on technical analysis

- most analysis is based on relative strength basis

- using candlestick charts

- using stock chart patterns

This strategy is only part of my broad trading system based on my business plan. Every trader should have its own business plan which defined a lot of basics of his market activity. Stock and funds trading should be considered as a business, otherwise it could lead to poor results.

It is also wise to have more then one trading strategy in your system. Why? The stock market is not always in one mode only. It has bullish periods, range movement periods and bearish periods.

It is good to have tools to be able to recognize actual stock market situation. And then apply correct strategy for exchange traded funds or stocks. It is not wise to buy pullbacks in bear market situation, I think .

The first step for this strategy is to prepare a list of ETF stocks I want to monitor regularly. Then, I divide these exchange traded funds into these groups:

- broad market funds

- market sector funds

- bond funds

- commodity funds

- international funds

- other exchange traded funds

The next part describes details about how I defined exchange traded funds in these groups for my trading strategy.

Find more on related pages

- Major ETF funds families

- Major Nasdaq ETF symbols

- Gain more knowledge about ETF Trading strategies