I have prepared “day trading for dummies” rules and a free day trading tips list below. There are plenty of day traders starting their stock market journey every year. If you are one of them you will find these rules of “day trading for dummies“quite useful.

Stock trading is a business

Every trader should understand that trading should be taken as a business activity. Only then is it possible to make money on the equity markets.

So the first decision that a new trader takes, is to understand how to prepare a complete business plan for this market activity. This business plan must be done by daytraders and all other trader types: swing traders, position traders, active and passive investors too.

Such a plan has a specific structure. The details will vary based on needs, goals and approach of every single trader.

Account size does matter

It can look strange, but it is much easier and less risky to trade with bigger accounts than with small accounts in this business. Traders with small accounts (few hundred or few thousand USD) tend to open positions with much higher risk than traders with larger amounts of money in their account.

Of course, having a larger account does not mean that all money is used every time. My personal experience is that most of the time I have spare cash in my account and I do not need to use any margin at all. It is possible to generate profits without using all money. It is only needed to have extra in the account for better risk management purposes.

Money management and trade management are part of every day trading strategy

First and foremost, the goal of every trader is to protect his/her capital. It is not possible to trade without money in the account. So it is critical to develop daytrading rules for money management.

Every trade should be based on risk reward ratio calculation and when a trade is opened it must be properly managed. Only using these rules will assure that intra-day trades could make money.

Day trading education

Stock market activity is a tough business. And nobody can do it without proper training and education.

It is very important to take time and learn all the important aspects of daytrading. The education is an absolute must for every starting daytrader. It is good to study best daytrading books and also attend some good daytrading courses.

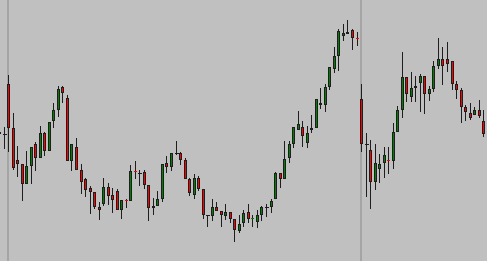

Simple daytrading chart

I have had very good experience with using newsletters for education. I did not use them to blindly follow picks and recommendations of day trading newsletter publishers. I read them to understand how the trader who publishes it thinks, why he/she does what is described in newsletter. How money management and risk management methods are used by him.

Develop your day trading strategy and test it properly

You have to be able to develop several daytrading strategies during the education process. It is important to describe all of them with daytrading rules and test them properly.

Testing should be done without using real money first. Use paper trading methods or stock trading simulators to test if a strategy is working and can make profit.

The second phase will be to test this strategy in real trades but with very small positions. With extremely low risk. This period is not for making money but for testing your strategy in real trading.

If this strategy proves to be profitable then it is OK to start trade this strategy with real money and also with standard risk size.

I would also like to recommend to develop several daytrading strategies. Each day could be different from another one. One strategy fits for standard days, another is better for days after huge gaps up or down.

Is it also OK to stay in cash and not trade. Cash is also a position! This is very important know how of day trading for dummies.