Biotech stocks represent an important part of the Nasdaq market. They are considered as technology stocks with big growth potential. And although their price movement is sometimes quite wild, biotechnology stocks offer good opportunity for traders.

Biotechnology stocks can be used for short-term trading strategies. These shares often have big intraday moves, so they could be good stocks for day traders. But biotech stocks are also good vehicle for swing traders and position traders, as they often move in strong multi-day and multi-week trends.

Active investors that use fundamental analysis could use the biotechnology sector for their investment strategies. Good market investment research is needed for using fundamentals for biotechnology stock investment strategies. Biotech companies often do not generate any profit before they discover some significant issue in the biotechnology area.

Select biotechnology stock using biotech etf index fund

There are two possible ways to find a list of good biotechnology stocks that could be traded using short term swing and day trading strategies. It is possible to use a list of stocks that are included in some index like the Nasdaq biotechnology index. It is possible to check the portfolio of any biotechETF.

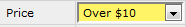

The most known and popular biotech fund is iShares Nasdaq biotechnology index fund with symbol IBB. This sector-based exchange traded fund holds a lot of biotech stocks in its portfolio. The biggest holdings are (as of 06/2012):

ALXN … ALEXION PHARMACEUTICALS INC … 8%

AMGN … AMGEN INC… 7,37%

REGN … REGENERON PHARMACEUTICALS… 6,60%

GILD … GILEAD SCIENCES INC … 5,52%

BIIB … BIOGEN IDEC INC … 5,45%

VRTX … VERTEX PHARMACEUTICALS INC… 5,09

It is possible to select these most popular biotechnology stocks for your trades. Or if you want to check other companies in this biotechnology index then check a detailed list of holdings for this iShares Nasdaq biotechnology index fund.

Use biotechnology stocks screener

Another option to find good biotechnology stock for online trading or investing is to use some screener that could look for these titles. Quite a good screener is on the FinViz website.

It is very easy to set up three major parameters to find liquid biotechnology tickers. Here are pictures that show how to set the three screener parameters: Industry definition, average volume and minimal stock price.

The final list contains 27 biotechnology stocks that can be immediately used for chart analysis or fundamental analysis and then included into some short-term or long-term investment strategy.

You can also use online stock screener available on ChartMill web site to find biotechnology stocks.

Basic rules for trading biotechnology stocks

As I mentioned above, there are many different strategies that could be used for trades with biotechnology shares. The details of every strategy for your trading system will be different, but all could have three common issues that I would like to describe below.

Check stock market situation

Biotech stocks are listed mostly on the Nasdaq stock exchange. So use The Nasdaq composite index to check the actual situation. Is market sentiment bullish or bearish? Can you spot a trend on the Nasdaq composite index chart? Or is it moving in a range?

Check Nasdaq biotechnology index situation

This is the most important biotechnology sector index so it is good to use this one for analysis of the situation in this particular sector. The situation could be checked on index chart or on IBB – iShares Nasdaq biotechnology index fund chart.

There are two major issues that must be learned from studying of this chart. The first one is what is the general situation in this sector. Is it bullish, bearish or trend-less?

The second important task is to define relative strength or weakness of this stock market sector to the Nasdaq composite index chart above.

Based on this knowledge you have to decide whether you are going to use a bullish or bearish strategy for your trade.

Select biotechnology stock that complies with selected strategy

The similar reading of stock charts should be done for all preselected biotechnology stocks. You have to decide what biotechnology stock is most suitable for the strategy selected in previous steps. The goal is to find the strongest stock for a bullish strategy or the weakest ticker for a bearish strategy.

An example of a bullish biotechnology title is BIIB, as you can see on the chart below.

ILMN is an opposite example. This is a really weak title and should be used for a bearish strategy for biotech sector.

Find more on related pages