Scanning for a short list of possible candidates for your best stock pick is a daily routine every trader does every day or several times a week. I personally analyze todays stock market situation and use my method for selection of best market pick almost every day.

This job of looking for 10 best stocks can be divided into two parts:

The first part can be automated and done by some software screener or Web site screener. The result of this first step is a list of possible best picks that should be reviewed during the second step.

The second part is to review chart of every pick in list. Don’t worry; when you practice basic rules and reviewing, you can make an individual selection very quickly.

Two rules to find best stock to buy today

Let’s start with the first part of the process looking for best market pick.

First, you need to define general rules that are independent of any market strategy or system. I personally have these fixed rules for any type of market pick:

- The ticker price has to be over $5 USD

- Average daily volume has to exceed 450,000 shares.

Other rules to find your next best stock pick

The next rule is relative to trade type (whether I plan a long or a short trade):

- Price has to be over 50EMA (exponential moving average) for a long trade setup or below for a short trade setup

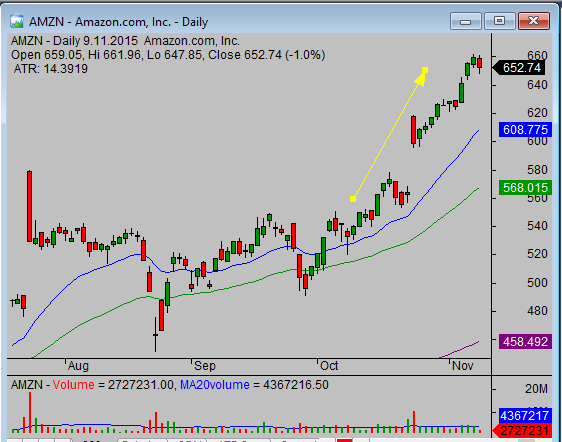

Best stock pick example

Hey, great. This is the first complete set of rules that can be used independently. I personally use them for trades based on my sector trading strategy. But now we will define another rule to do a complete scan for potential profitable stock pick.

I like to use support and resistance. Breakout and also Pullback strategies are based on them. Therefore, I want to have a scanner that will find stocks with a price near a significant level of support or resistance.

I define this level as the last three months of maximum or minimum stock price. My scan rule is to find stocks with the last price less than 5% of the three-month maximum or minimum.

Volume plays an important role in my analysis so I recommend you include a special volume rule into the scanner. This rule is based on the condition that we’re looking for a ticker that’s picking up. So, the rule is to find shares that’s had above-average volume sometime during the last 20 days.

Best stock pick example – the result

Well, here’s the list of all rules:

- The share price has to be over $5 USD.

- The average daily volume has to exceed 450,000 shares.

- The price is over (for long trade) or below (for short trade) 50 EMA

- The price is no more than 5% from the three-month maximum (for longs) or minimum (for shorts)

- Stock volume exceeds average volume some time during the last 20 days

These five simple rules allow you to find your best stock pick for the next trading day. Automatically.

You can define these rules in your technical analysis software. I like AmiBroker very much, and I think it’s the best software for picking stocks and for chart analysis.

If you want to receive more tips how to find top stock pick then join my free email course: 7 TIPS FOR STOCK PICKING AND SCREENING.

Find more on related pages

- Simple way to find day trading stock picks

- Identify 10 best stocks from Chinese stock market

- Explore more ways to improve your stock trading system