The best stock trading system is the goal of every trader. There are plenty of stock market systems available publicly for traders and investors and there are new stock market systems created every year. Not too many of them could be used as best stock trading systems.

The first groups of these systems are mechanical systems. They are based on some mathematical formula and are traded automatically by computer without personal activity of a human trader.

My personal approach is different. I am discretionary trader so I select every trade setup individually, I even use a defined set of rules for every trade setup. This type of trading allows more flexibility in my system. But it can also create many more errors and mistakes.

I do not think that to have loss in a trade is a mistake. The mistake is a situation when a trader acts against his own best stock trading system rules.

There are statistics and reports proving that every trader makes errors. These errors cost money as they mean that the final result of the trade is bigger than a usual loss or that profit is much smaller then expected profit.

The best traders in the world make mistakes too. What makes them the best trades in the world is that they are able to identify their mistakes and learn from them. They also do not repeat these mistakes and modify their best stock market system accordingly.

How to avoid every day trading mistakes

There is one important condition that must be accomplished to be able to avoid and correct errors in best market systems. The first step is to recognize the error.

How can we recognize that we made an error ? Well, there must be a good business plan in written form. This plan should have description of stock market system with one or more stock strategies and other important rules.

When you have such a plan you can compare your actions with it and decide if there is some error.

What is a stock trading error

A trader’s mistake is when you act differently than you have to. If you do something against the rules in your best system.

And as I said – when a trade finishes with a loss it does not mean automatically that there was some error. Small losses are a normal part of this business.

When to look for every day trading mistakes

The ideal time for this search is after you have finished trading in a current day. It could be after the close if you are a swing or position trader, or during a weekend if you are an active investor.

The process when a trader is checking if he/she has done market activities in accordance with his/her plan is called debriefing. I have noticed this term in the book of Mr Van Tharp I read some time ago. This process consists of checking major activities during a day and whether they were done correctly.

What parts of best stock trading system should be checked

Trade entries

If I have made some position entries , if I have opened some trade during the current day, I check if I have done it correctly. If my every day rules were not breached.

Trailing stops

I check all open positions I have in my portfolio and I check if I have done trailing stop changes correctly. What if I have forgotten to adjust stop loss level?

Trade exits

This part consists of not only profit taking but also exiting of a losing trade. Was every exit done in accordance with my everyday rules? Was all done according to my best stock system?

If I find that I made something incorrectly or I missed something, I write this error into my notes and also into my trade journal & diary. I recognize where I made a mistake and try to fix the problem and do it correctly next time.

Checklist helps

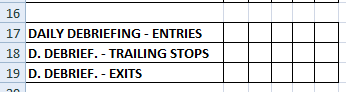

I put these three important parts of my daily debriefing routine into an Excel table that I print every day. This table is a list of tasks I must do before the market opens and also after the market closes. It helps me to be a disciplined trader.

Find more on related pages

- How to set stock market graphs for your trading systems

- Inspire by ETF trading system for short proshares etfs

- Find another details of profitable stock trading system