This second article of a short tutorial describes another important fundamental value that should be included in your fundamentally based best stock screeners. These screeners are used mostly for longer-term investments but I think that it is nothing wrong to select healthy companies also for short or mid-term trades

I recommend to use these three values for your stock screeners: the profit, the growth and the undervaluation. It is based on a logic that each of these values could confirm future rise of the share price for any company. So why not to use them together?

The profit filter for the best stock to invest in

P/E (Price-to-earnings ratio) s probably the most popular idea how to check company profits. This value is published almost everywhere, in financial newspapers, company web or major financial online websites. The best stock screeners include such a value as well.

This value shows how expensive are company shares valued to each dollar of profit. But I do not think it is very valuable. Why? This value is based on the history. It tells nothing about future profit.

And as many investors know the expectations are the issue that should be monitored. Investor’s expectations are what move the share price up or down. So it is much better to check expected price to earnings for the future. Or expected growth of price to earnings.

One elegant solution is also to calculate earnings yield. It is something similar like dividend yield but based on earnings. The formula is defined this way: earnings yield = 100 x (1/PE)

P/E in screeners

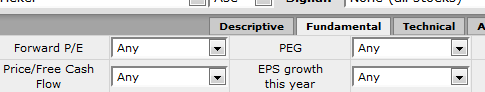

Here is an example of the FinViz site. There are many stock screeners filters available. The two I want to note are Forward P/E, or forecasted P/E value. The second one is PEG or Price-To-Earnings-Growth.

Find more on related pages

- Read about growth value in fundamental screeners

- Master the selection of undervalued stocks

- Read more about stock screeners