Many stock traders often use a stock’s close price in chart analysis. But some traders often ask whether it’s more important to use the close price compared with the high or low price levels.

There are several ways to use these data points. Here’s how I recommend you use these price levels in your chart analysis or stock trade management and execution.

Support and resistance level construction

The first point is that support and resistance are not based on a single price value. Rather, they’re on areas or levels. So, you cannot simply use only a single price point to draw support or resistance. But you can use opening/closing prices and high/low prices to use them together to define these important levels.

You can see this on the weekly chart (if you’re a swing or position trader). If you use shorter time frames—hours or minutes—then you should have it on a chart you can use for a longer time frame period for your trading style.

Here’s an example of what I mean.

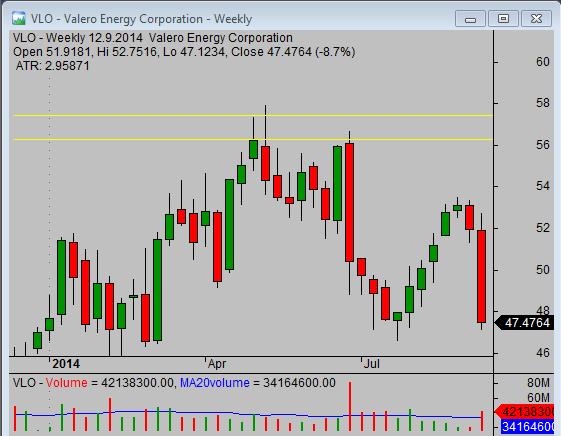

As you can see on this weekly chart, the VLO price moved between 56 and 58 but never closed a week above the 56 USD. The action during April 2014 defined the resistance area between these two price points.

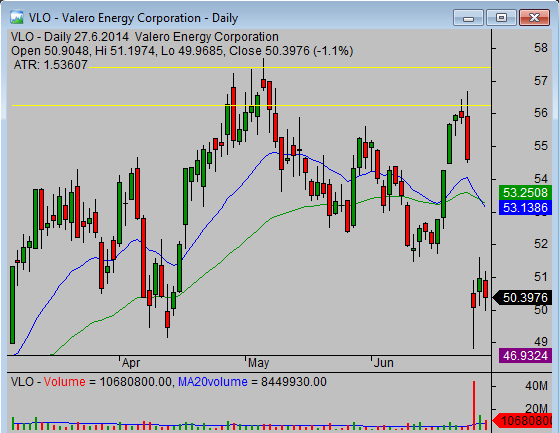

You can see that it’s more visible on the weekly chart than on the daily chart below.

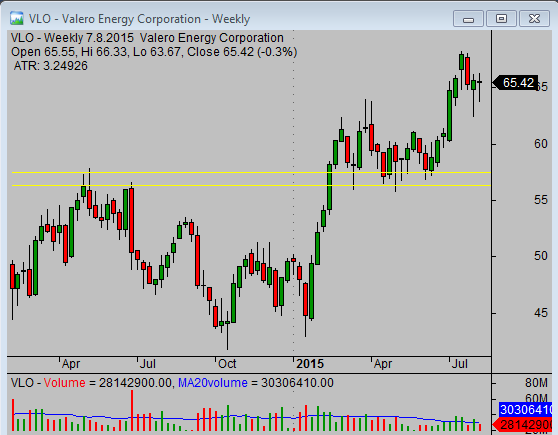

Finally, this resistance area later turned into a support, and this breakout proved valid during April and May 2015. While the price moved through this support area several times, it never closed below.

So, this is a reason why I think that closing and opening prices are more important than high or low price points.

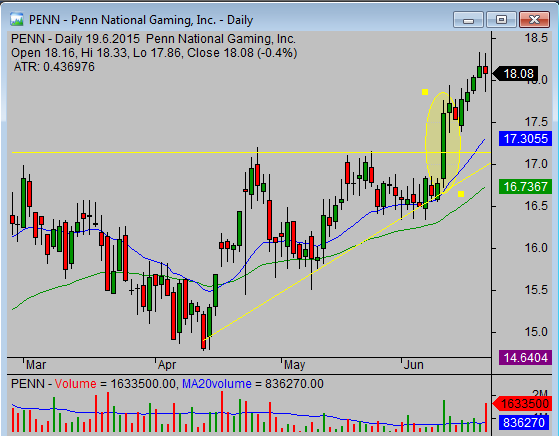

Validity of breakout or breakdown

The second reason for using the stock closing price is a validation function. I’ve had this experience many times: I entered a trade during the day only to see the price reverse its move during the final hours of trading and return or went below my entry price.

This is a trade failure, and I have rule to exit a trade when I see that the price goes below my entry price during the day of an entry.

When the price confirms a breakout (or a breakdown), then you can feel much better to have this trade opened. There’s a much higher possibility of further movement in your direction.

Conclusion

The stock close price is much more important than high or low price levels. Using the closing price for your stock chart analysis or for a real trade execution and management is a much better option.