Nasdaq index fund is a good addition to every ETF list that is used for etf trading strategies. ETF trading is a good way to make money on equity markets and the current offer of exchange traded funds is really huge and can be well used for profitable trading strategies.

Market index etf securities are good for these fund strategies and should be included in the list of every ETF trader. Active investors should have them in their list of best ETFs for fund investing, too.

Nasdaq index fund represents the technology part of the total US stock market. The Nasdaq exchange provides a platform for listing and trading that is used mostly by technology companies. You can also find there companies from other sectors, but technology sector prevails.

Two major Nasdaq indexes

There are two major Nasdaq indexes that could be used for trading purposes. Nasdaq composite index is a broad index that tracks performance of more than 3000 stocks listed on the Nasdaq stock exchange. This index covers the whole market stock total exposure. The market ticker for the Nasdaq composite index varies based on data sources. But the most common ticker is COMPQ

The second one is a more narrow Nasdaq-100 index that tracks performance of 100 major companies that are listed and traded on the Nasdaq stock exchange. The market symbol for the Nasdaq-100 index is NDX.

Nasdaq index fund list

Which Nasdaq index fund tracks movement in the indexes above? Well it is not complicated to answer this question. There are two best ETFs that are used by most traders for ETF trading strategies and by investors for fund investing.

Fidelity Nasdaq composite index ONEQ

ONEQ is an exchange traded fund tracking the Nasdaq composite index i.e. complete technology market stock total exposure.

PowerShares QQQ

PowerShares ETF with symbol QQQ is an exchange traded fund that tracks the Nasdaq-100 index

I personally prefer to trade these two exchange traded funds too. They can also be used to analyze the Nasdaq stock market situation without needing to look at market indexes above. They help to define index market stock timing for traders and investors, too.

Leveraged and short etfs for Nasdaq indexes

ProShares fund provider offers the possibility to use leverage for single day moves. This leverage is really only for a single day so these leveraged and short index exchange traded funds are usable only for short term strategies. They do not have similar performance when they are held for weeks or longer. These index exchange traded funds are really the best ETFs for daytraders or short-term swing traders.

Here is a short list of these ProShares ETFs:

Short QQQ fund with symbol PSQ seeks a return that is -1x the return of the Nasdaq-100 index for a single day.

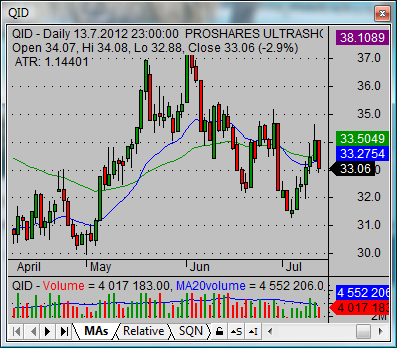

UltraShort QQQ fund with symbol QID provides a return that is -2x the return of the Nasdaq-100 index for a single day.

UltraPro Short QQQ fund with stock market ticker SQQQ provides a return that is -3x the return of the Nasdaq-100 index for a single day.

Ultra QQQ fund with trading ticker QLD seeks daily investment results that correspond to 200% of the daily performance of the NASDAQ-100 Index

UltraPro QQQ – ticker TQQQ – is like QLD but it offers 3 times leverage. It should provide a return that is 300% of daily performance of the Nasdaq-100 index

Find more on related pages

- Compare vanguard index funds with your watchlist

- Note this simple and easy to use etf screener

- Read more info how to trade exchange traded funds