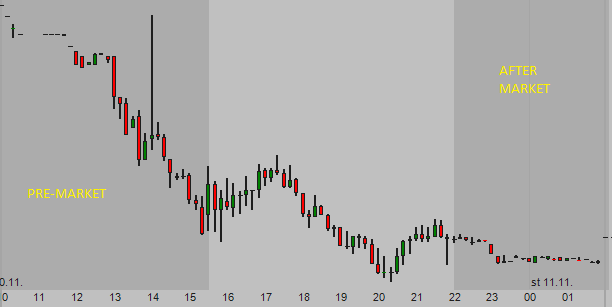

After hours stock trading and pre-market time are jointly known as extended trading hours. But what does it mean? And how is after hours and pre-market trading on exchanges possible, and can it be profitable?

Standard hours for stock exchanges

First, the basic knowledge is that there are standard opening market hours. During these standard hours everything works under the rules offered by stock exchanges.

Take the U.S. market trading hours as an example. They’re from 9:30 a.m. till 4:00 p.m. Eastern time (New York time).

Pre and after market stock trading hours

But it’s also possible to enter orders and execute trades outside these opening hours. There are several marketplaces connected to the main stock exchanges or parts of stock exchanges that allow entry and

execution orders during extended trading hours.

Pre-market trading hours

are typically from 8:00 a.m. till 9:15 a.m. ET (New York time) for NASDAQ and NYSE stocks. But using NYSE Arca ECN you can enter and execute orders from 4:00 a.m. to 9:30 a.m. ET.

After hours market trading can be done from 4.00 p.m. till 8:00 p.m. on the NYSE and till 6:30 p.m. on NASDAQ.

I do not do trades during these extended trading hours. Market prices are not as stable; alsothe liquidity is not so good. No price is guaranteed, and a price can be manipulated a lot (by the news, etc.).

Can be after market stock trading profitable?

I personally know traders who use special event driven momentum short term strategy and trade mostly during these hours – and are profitable. But this type of trades is very specific, and strategy must be learned and perfected.

Such strategy for momentum trades is based on an earnings results research and the psychology of a reaction. As most companies publishes their quarterly earnings results during these extended hours, such strategy should be traded during this time.

Why are after hours stock trades risky?

There is a big risk in trades during this time. There is not guaranteed liquidity in extended time for trades. The Bid / Ask spread could be very wide and could be very complicated to open or close stock trades.

I personally do not recommend to open new position during these hours. Only option is to exit a position as mentioned above. This advice holds true also for usage on international stock markets, not only the US equity market.

Find more on related pages

- Want to know more about 24 hour stock trading?

- Explore this way to learn stock market trading and investing

- Read more tips for traders