Swing trading stocks are a common way to generate regular income or increase wealth on your trading account. But mistakes can diminish the results of many swing-trading strategies that usually work. You can easily avoid swing trading system mistakes if you learn them in advance and understand how to avoid them.

Everybody make mistakes, and traders are no exception. The key in trading is to learn how to avoid them. It will save you a lot of money, but also a lot of time when you try to correct these stock swing-trading mistakes. The most profitable swing traders make mistakes minimally, and that’s what makes them profitable.

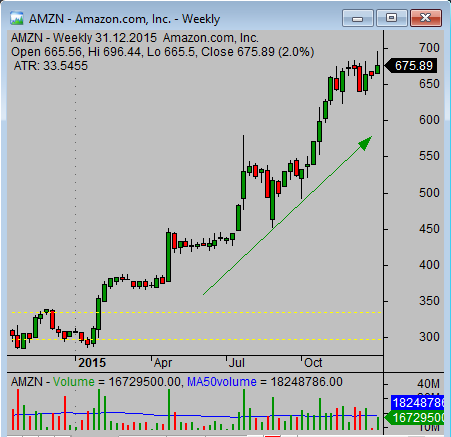

Shorting against an uptrend

Shorting into an uptrend is a classic and common swing trading mistake. A trader has his belief and sticks to it even when the situation tells him the opposite is true. The typical idea in a trader’s mind is that “such a bad stock cannot go higher.” He starts to short this stock only to see that the price slowly climbs upwards. After several painful days or weeks, this trader often exits the trade with a loss. The loss is as large as the strength of the trader’s belief.

Fundamental background often underlines this idea. The trader mixes the fundamental basis with short-term trading, the combination you have to avoid. Short-term trading uses technicals as a preferable way for swing-trade planning and reading of the price action. These values typically prevail over fundamentals in a short-term time horizon.

Never short stock in an uptrend

Avoid this mistake with proper analysis of what the current stock chart short-term situation is. If the price shows a buying interest, then don’t fight it. Make the opposite an opportunity.

Buying when the price declines

Maybe you already heard about catching the falling knife trades. These trades are opposite to the previous mistake but lead to the same results—major losses. Traders often see their favorite stocks falling strongly, and since they like the stock for some reason, they think, “It should reverse soon, so I’ll buy it now.” But the price continues to decline and finally these traders experience such pain from the loss they cannot stay in the trade any longer. They close the trade with a huge loss.

A downtrend can push the price lower than you expect

Here’s a tip on how to avoid this swing-trading mistake. An idea you have to remember is that there’s always a reason for a price decline. So, avoid making emotional and momentum trades when you see such a huge price action. Plan every trade in advance so you’ll know what to trade and how to trade. If you’re interested in this falling ticker, then place it on your watch list and monitor it for several days. Then, you’ll see whether some opportunity emerges.

Not taking profits

It sounds strange to speak about not taking profits because everybody thinks it’s easy to take profits. But nothing is so far from the truth. Every swing trader experienced this mistake when he started to swing-trade stocks. I made it many times when I started. Greed fills our head and blocks our decision to close a trade and take profits from the table.

You see a huge profit in a P/L statement of your trading account and start to think the price can go more in your direction and generate more profits for you. Maybe. But if your price reached your target area, then it’s always a good idea to take all or some money from the table. Remember, all P/L profit in the open position is only “virtual” until you close the trade and change this virtual money for real money. Only real money counts.

A proper trading plan for every single trading opportunity will help you eliminate this mistake. Defining your target area and ideal target price will help you decide there’s a time for a trade exit. Also, remembering that it isn’t possible to always take the maximum from any single trade helps. We always take only part of the min to max movement.

Solve all these swing stock trading system mistakes with this simple task

The key to solving these problems and improve results of your swing trading system is to use a plan. Create a list of rules you will follow. These rules will always tell you what to do and what not to do. A simple bullet point list of major ideas you have to follow can increase the profitability of your swing trade system significantly.

Find more on related pages

- Learn to gain from short stock trades

- Find more about profit taking rules

- Explore more tips for good stock trading system