Stock market day trading is one of the very popular ways to be an active trader in the financial markets. I personally do these trades as well swing plus position trades. Day traders open and close during few hours or minutes; they don’t have any open trades overnight.

This is usable trading style for making money in the stock market. It has its pros and cons. Ultimately, everybody needs to recognize what style is best for him. There is not only personality that plays role in this decision. One has to consider also his time availability based on his occupation or time zone where he lives.

Trade rules for daytrading

These trades must be based on rules. Start with basic rules for trades when creating plan for your daytrading activities. There are no daytrading secrets. There is only need to know about several different issues to become best daytrader. Using simple rules is also a good way to create a daytrading system. Trader needs to decide about entering and exiting trade very quickly.

Most successful daytraders’ systems are based on the simple principle of support and resistance. Break or pullback on these levels can offer very good opportunities during opening hours.

Best software for pattern day trader

Selection of trade platform is important task as this could be a one of key day trading tools for profitable daytrades . It pays to read some software reviews and read more about important features for trading software.

Trading software for daytraders – TWS

Stock volume

If you consider to do such stocks daytrades then you must think about stock volume. Liquidity is very important risk factor for your system. You should be able to enter and exit trade by click without any movement in price.

Looking for good candidates means that you will use some screener. Such screener should offer liquid picks. I would set 1 Million shares traded as minimum average daily volume for best market picks.

Stocks for daytraders

It is important to create good daytrading system. It is better to have several different daytrading strategies or combine strategies for daytrades with swing or position strategies for your trades.

Why? There is not always good time to use only one strategy. Have a list of several strategies in your trade system.

When you prepare your own strategy then it is good to consider what parameters should have best stocks for daytrading strategy. There is also possible to select best stock pick for these daytrading strategies with good screeners.

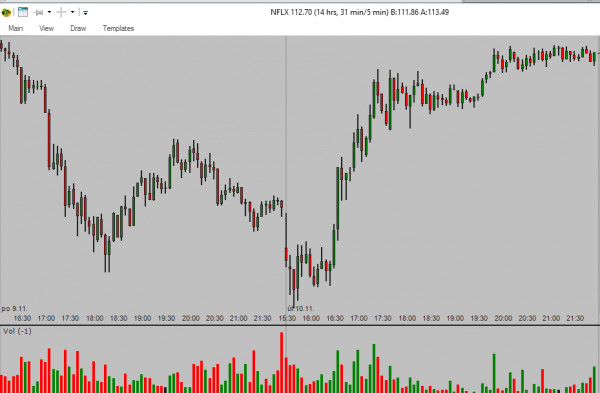

NFXL – stock for daytraders

Daytrading strategies

There are plenty of strategies for daytraders. Every trader could have different preferences, different reasons for trade setups and also could trade different stocks. There are four rules of for beginners that describe ideas for building of any daytrading strategy.

Testing is very important part of creation of profitable systems. There are some key parts that are included in all successful short term trades QQQ daytrading systems could be based on several different short term time frames for streaming stock charts that could be set in day trader software.

Or it is possible to use index fund daytrading. Many simple strategies use classic chart patterns as single tool for traders. This AAPL stock very short term stock trade is good example of daytrading using pennant chart patterns.

Candlestick patterns are very usable for day traders. Check these high-profit candlestick patterns for day trading.

Here is sample bullish day trading strategy for beginners.

Risks in daytrading

There is also risk in daytrading. It is not risk-less activity. It is good to know what are risks of short term trades and how to avoid major mistakes in these trades.

Finally do not miss these four tips to be a successful day trader.

Find more on related pages

- Find more tips and ideas for stock traders