Leveraged ETF shares are quite popular vehicles used for online trading and investing. They were introduced by several providers. A lot of them are inverse ETFs making profit when a particular index drops.

So far so good. These leveraged shares offer opportunity for investors who do not want or who cannot go and sell shares short. It is also possible to use these inverse ETFs when shares you want to short are not available for shorting by your broker.

There are also exchange traded funds which are allowed to be leveraged on the long side of the trade. You can make 2 or 3times more run-up when the index is going up. But there is also risk there. More below.

I personally do not track these inverse etf shares too often. I monitor standard exchange traded funds and only when I spot some shorting opportunity I am looking what is better – to sell short normal etf or use leveraged etf.

List of popular Proshares leveraged etf

ProShares is a big issuer of leveraged exchange traded funds. Their list of long leveraged funds has 48 tickers available. I list here only some of them and I recommend going to their site to see all available ETF tickers.

3x Leveraged shares

| UDOW | Ultra Dow30 | 3x Dow Jones Industrial Index |

| UMDD | Ultra Midcap400 | 3x MidCap index |

| TQQQ | Ultra Nasdaq100 | 3x Nasdaq 100 index |

| URTY | Ultra Rusell 2000 | 3x Rusell index |

| UPRO | Ultra S&P500 | 3x S&P500 index |

Leveraged Inverse ETFs – 3x

| SDOW | Ultra Short Dow30 | 3x Dow Jones Industrial Index |

| SMDD | Ultra Short Midcap400 | 3x MidCap index |

| SQQQ | Ultra Short Nasdaq100 | 3x Nasdaq 100 index |

| SRTY | Ultra ShortRusell 2000 | 3x Rusell index |

| SPXU | Ultra Short S&P500 | 3x S&P500 index |

leveraged inverse etf SQQQ

Some Leveraged Long Proshares

| DDM | Ultra Dow30 | 2x Dow Jones Industrial |

| MVV | Ultra Midcap400 | 2x MidCap index |

| QLD | Ultra Nasdaq100 | 2x Nasdaq 100 |

| UWM | Ultra Rusell 2000 | 2x Rusell index |

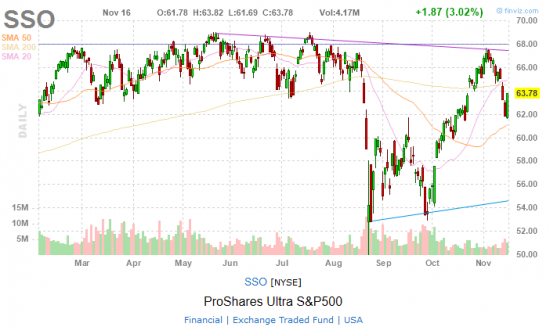

| SSO | Ultra S&P500 | 2x S&P500 |

leveraged etf SSO

Major Leveraged Inverse ETFs by Proshares

| DXD | Ultra Short Dow30 | 2x Dow Jones Industrial |

| MZZ | Ultra Short Midcap400 | 2x MidCap index |

| QID | Ultra Short Nasdaq100 | 2x Nasdaq 100 |

| TWM | Ultra ShortRusell 2000 | 2x Rusell index |

| SDS | Ultra Short S&P500 | 2x S&P500 |

You can find a complete list of these leveraged long and inverse ETF on the ProShares ETF website.

Where is risk in leveraged etf and inverse etf shares

The risk associated with these leveraged exchange traded funds is in two major issues.

First is that these leveraged exchange traded funds use derivatives like options, futures and swaps – where time value also plays an important role. Time value decrease ovet time so it puts some costs to these funds.

Second issue is based on the mathematic model on which such leveraged ETF is constructed. As the market is moving not only in one direction but typically up and down over the time, mathematic rules dictate that these exchange traded funds are not able to track market indexes one to one and are often laggards.

So the major implication for using such leveraged exchange traded funds is that they are better for intraday trading or short-time hedging than for long-term holding. If you plan to short the market index or specific sector or commodity for a longer period of time, do it by shorting of standard long ETFs instead of leveraged inverse etf.

Find more on related pages

- Short and Ultra inverse ETF securities

- Inspire by top 10 most liquid inverse ETFs

- Collect more details about ETF shares