How to trade stock breakout is quite a common question I receive several times a year. Breakout stock trading strategies are a good type of market strategy for online securities trading. Breakout trades could make very good profits if they are done and managed well.

A breakout strategy is a good option, especially for traders that want to trade stocks from home. Swing trades and position trades need not so many trade management steps to make good profits.

Six steps to profitable breakout trade

The trading plan for a breakout strategy is based on several simple steps. They are simple but must be done well to achieve desired results and make profits from a trade.

- Check that general market trend is bullish.

- Pick the best bullish breakout trading opportunities available today. You can use these best scanners like I use

- Set an entry, stop loss and ideal target values for your trade opportunity, i.e. prepare a trade setup

- Check risk reward ratio

- Put the ticker into watch list and wait for entry trigger

- Manage the trade after an entry till exit

Always look for bullish market mood

A breakout strategy produces very good trading results only in a bullish market situation. It is not a good trading strategy in a bear market where most breakout trades fail.

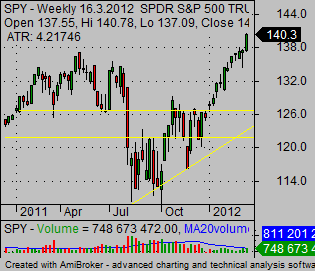

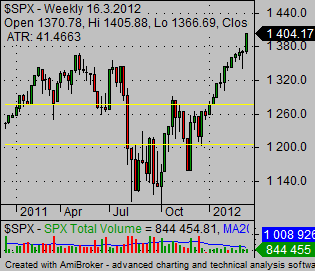

Therefore, the first key point is to confirm that charts of the stock market indexes are bullish. The major US indexes are Nasdaq 100 Index and S&P500 Index. I personally monitor these two indexes for my market mood analysis. Any trader who trades mostly on US exchanges should check these major indexes.

There is also one alternative that uses index exchange traded funds for technical market analysis. There are index ETF securities with symbol SPY and QQQ. SPY represents the S&P 500 Index and QQQ represents the Nasdaq 100 Index. You can analyze them instead of indexes.

When you find that the actual situation with major US indexes is bullish, you can think about using breakout strategies. Do not try to trade bullish breakout trades in a bearish market situation. These trades will fail most of the time and it will hurt the profitability of your trading system a lot.

The best type of setup for a breakout strategy

There are several points that must be fulfilled for any good setup for a breakout trade. The basics of knowing how to trade stock breakout start with a selection process that looks for candidates for such bullish breakout trade. This process can be easier using some good market screener that helps to filter the most suitable candidates for this type of online trade.

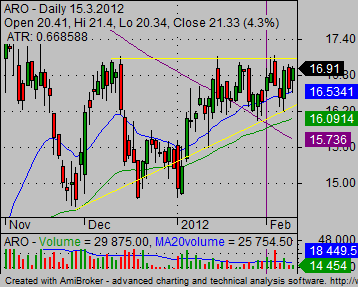

But before you can scan for your trading opportunities you have to know what is a typical stock chart of a good trading opportunity. The best candidates should have charts like these examples. As you can see these charts look typically like a ascending triangles chart pattern or a cup and handle chart pattern.

Such a screener produces a list of good candidates for a breakout trade. But you have to do more and find excellent candidates for a breakout trade. You have to go through the list of screener results and check charts one by one. And select only the best opportunities. The best candidates should have charts like these examples.

It is normal if you finally select only a few trading opportunities. You do not need to find tens or hundreds of them. It is good to finally have one to four breakout trading opportunities

Find more on related pages

- Expand you knowledge about the breakout strategy for stocks

- Learn how to trade stock breakouts

- Continue reading about the best trading strategies