My personal opinion is that every trader or active investors should know how to short stocks. This knowledge should be part of your best trading system as a short selling stocks strategy.

It is common that equity markets do not go only up. They also have times when they make corrections in rising trend. And they also have times when the markets drop and move down in strong downtrend. It is often called a bear market.

Even in rising markets you can find stocks or ETFs which are presenting relative weakness and are in downtrend.

These downward moves in correction or in downtrend offer huge opportunity to make big profit in a short period of time. Why? It is known that emotions affect equity market moves a lot. Investors often allow their greed and fear to control their investment decisions. And fear is a much stronger emotion then greed. So as you can see, downtrend moves are often much stronger and much faster than uptrend moves.

Bear stock trend is opportunity for selling stocks short

This fear is a great opportunity for any trader or active investor who knows how to short stocks or short ETFs. He/She can also generate nice profits also during market decline or a stock market panic. Just look at recent examples of market drops.

The SP500 index formed reversal stock chart pattern known as head and shoulders. When a support neckline was broken, the market dropped hard.

If your stocks trading system has also incorporated a short selling stocks strategy then you are able to prepare a trading setup to short ETF SPY. It was possible to make a huge profit on this 10% decline move from 123 to 114. And all in a situation when average investors are caught in panic and fear and are selling their positions with losses.

How to short stocks using your best online broker

It can look like rocket science, but it is not. Selling stocks short is as easy as buying them for long trades.

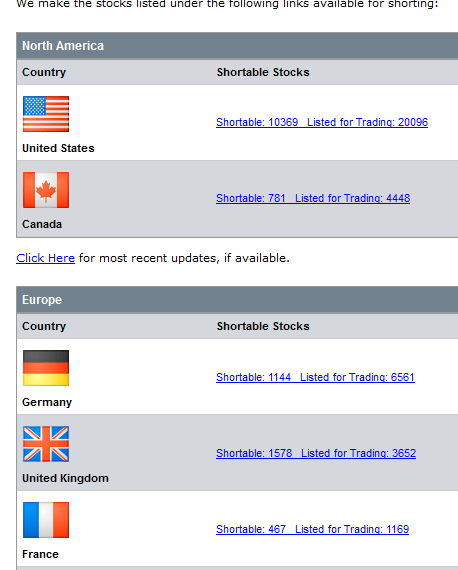

The first issue you must check before short selling stocks is if the shares are available for shorting. Not all stocks are available for shorting on a specific day. A good stock broker has a huge inventory of stocks available, so just check its list of stocks to short.

It can be found on the web pages of the broker or best brokers allow you to check it in their trading software.

Here is an example of how a trader can see if he can short a stock by checking the web page of a best broker with a list of stocks available for shorting.

If your ticker is available then you can sell a stock short. Trading mechanics of shorting stocks is very easy. When you want to sell a stock short then you click to SELL button first. Yes – you will arrange a sell order first. Your broker automatically loans shares to you. Then they are automatically sold when the conditions of your order are met.

When you want to close a trade you do the opposite, you BUY stocks. Some brokers have only simple buy buttons or simple buy orders. Some brokers have two separate orders or buttons in their trade software for shorting stocks. The first one (opening) is SHORT SELL and the second (closing) is BUY TO COVER.

But it is really very simple to know how to short stocks. Just remember that when you are shorting a stock you do SELL first and close such trade by BUY.

What risk is associated with short selling stocks and etf

Shorting stocks is associated with risk. Every stocks trade should be properly managed and all trades should be based on the money management part of your stocks trade system. The most important part of every trade management is to use stop loss orders and stop loss levels.

Please understand that if you sold stocks short and the trade goes against you, then the price can rise very much. It has no limit on the upside. So your stop loss must be used every time! Otherwise you can experience big loss. And it is a result every trader should avoid in his trading to generate big profits.

Find more on related pages

- Reasons to look for bearish daily stock picks

- Double tops reversal stock chart patterns ideas

- Find more about shorting stocks