When you want to select the best stocks to buy you can use several ways to generate such a list. It is possible to use fundamentals or technical parameters to set up your stock screeners looking for your ten best stocks.

Here below in a short tutorial I would like to describe three major fundamental values that play the most important role for selection of your stock picks.

The profit and sales growth

The growth is the first important value you should check. When I speak about growth I speak about year-on-year change, typically described in percents. The taxes and inflation destroy the value of any company. So a company should defend itself against these enemies. Otherwise it will finish bankrupt or vanish from the market.

Do not omit to check the dividends when checking this growth value. If company pays huge dividends but a profit growth is small then it is not good for the future. And you select companies for future rise in the price, not for a decline.

Also do not check past profit growth. It is a history. Always look for the estimate for the future. So the growth forecast is the value for your scanning.

It is always good to check also forecast for future sales growth. Sales and profit are closely related values. The example of problematic situation is when sales rises but profit does not. It is a warning point that something in not good with the profit margin of the company.

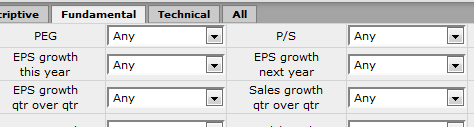

How to use online stock screener for growth filter

The FinViz site offer free online stock screener that allows to select from many fundamental filters. It is possible to select filters like future EPS growth or Price-To-Earnings-to-Growth and similar values.

Find more on related pages

- The second important fundamental value for stock screeners – the profit

- More parameters to find the best stocks to buy now

- More details about stock screeners