People often ask how to invest in stocks especially when they see stocks they bought as investment drop in price. It is a common issue that only a few investors try to learn to invest in stocks before they make any investment decision.

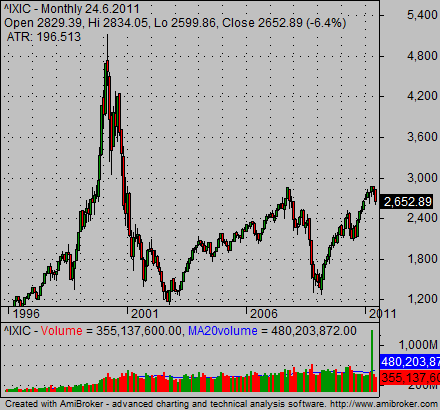

There are a lot of investors that were super gurus during the bull market in the 1980s and 1990s that understand how to pick best stocks to invest in. It was easy to pick any stock, wait for small decrease in price and buy it. It was almost sure that price would rise again to new highs.

This bull market lasted so long that a lot of investors did not learn anything else other than prices had been rising only. It was an easy time for “buy-and-hold” investors.

But the situation changed at the beginning of the year 2000. The first significant bear market drop in the year 2000 wiped out a lot of investors.

Many investors already finished with such a small amount of money that they resigned to start investing again. And many of them also blamed everybody else but themselves for this result. The truth is that they received what they were prepared for.

How to invest in shares with smallest risk

Everybody must understand that there is risk associated with stock investing. We are not now in a long lasting bull market and situation is much more volatile. Equity markets experience strong uptrends followed by volatile moves down in bear market mood. It is not time to be a buy and hold investor.

It is all based on economy. It is not possible to have only an rising economy. Every economy has ups and downs, expansions and recessions. Central bankers and government are trying to avoid recession to see only growth, but their fight is not going to be successful. The longer they block the decline in economic activity, the stronger the decline will be.

We were able to see the first sign in the period from 2003 to 2008 when the easy monetary policy of the US central bank stimulated very good growth only to be replaced by a very strong decline in economic activity. But it looks like central bankers do not have any memory, as they are trying to stimulate the economy again and not allow a cleansing process to wipe things that are not working and allow new healthy economic expansion again.

This situation is very risky for buy-and-hold passive investors. It is time to be a much more active investor or start to be a more active trader to achieve expected results. And everyone must understand that only he or she is responsible for his/her results. This is the first answer to question of how to invest in stocks.

Good business plan helps to invest in stocks

The second important point is to prepare a good business plan describing the basics of how to invest in stocks. This plan helps to define the framework for a more detailed description of the stock trading system and stock trading strategy that will be used.

Minimize risk and protect your money even with best stocks to invest in

A very important role in all activities related to the market is to minimize your risk. The truth is that not all trades will finish with profit. There are also losses accompanying some trades. But it is normal, it is not a mistake. The key is to keep your losses small and hold your winning trades to generate big profits.

The key role in this process is to play stop loss techniques. Every single trade, every single investment must be accompanied with a stop loss. Even if it is the best stock to invest in. Every time money management rules must be used for every single stock pick. Even if you select best growth stocks for your trades you must limit your risk.

Remember that it is not a mistake to finish your trade or investment on stop loss and realize a loss. The problems often happen when the first possible loss (that was small) was not realized. Then it is almost sure that the price will dive much further to the point where loss created on the trade is huge. And this is a situation that must be avoided. The best traders and investors in the world know it and do everything against it.

Keep in mind: it is not necessary to have all trades or investment decisions end in profit. 50% of them is enough to make nice gains for a year. So honor your stop loss levels. It is the biggest secret that answers questions How to invest in stocks and avoid losing money.

Find more on related pages

- How to invest in stock market wisely

- How to invest in commodities

- Find more ways to invest money