It is tough for a lot of investors to find reply to this simple question: “How to find the best stocks to invest in?”

Here below I described a few samples of shares representing the best additions for your investment or a short-term stock market portfolio. Similar stocks could be found all the time in a bull or a bear market situations. There is always something that is worth to buy.

I use simple approach to my decision making process. So my advice is to make it as simple as possible if you try to find the best stocks to buy.

Some ideas for growth stocks selection

I have prepared a simple list of parameters that could be used for selection of best stock picks for your growth stocks portfolio. It could be simple to have preselected tickers based on these fundamentals. Many of them could be best stocks to invest in.

And how do I look for best stocks to buy?

First I do not look for long-term investment. The trades I do in my personal portfolio are mostly short-term and mid-term. They last days, week or a few months. Why? I do not want to wait too long to know if my selection is profitable or not. I like to cash profits soon to be able to deliver absolute return every year. In a bull but also in a bear markets.

Basic parameters for best stock picks

Tickers aspiring to be the best stocks to invest should signalize great relative strength. What does it mean? It means that such a stock is the best one to buy also for another investors, preferably for big investment funds with a lot of money. Such shares do not drop too much when the markets dive. These shares rise much more when the market rises.

Examples of best investment picks

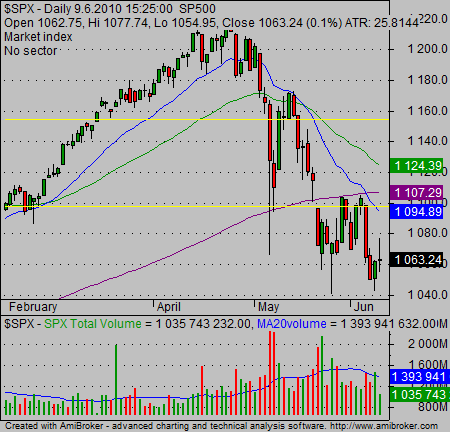

The US market dropped in May / June 2010 as you can see on the chart of the S&P500 index. But several stocks performed nicely. They represented good opportunity for best trade. Stocks I planned to buy them when they reach some support level.

Find more on related pages

- Upgrade your results with knowledge how to trade iShares etf

- Learn to use relative strength for technical stock market analysis

- Understand also other ways to invest money