The Chinese stock market is attractive place for an investment for plenty of investors. The question of “How to invest in China” is quite common on many online stock trading forums.

There are several options how an investor or trader can gain access to the Chinese equity market and Chinese shares.

The local Chinese exchange is restricted to domestic investors and a few selected institutional investors only. The Chinese government protects its own stock market and economy and capital flow is strongly restricted in the area of equity market investments.

Traders and investors could find Chinese stocks traded in Hong Kong. The Hong Kong exchange is open for every investor and good brokers already offer access to this major Asian stock exchange.

Unfortunately Hong Kong is located in time zone with big difference in time to European and American investors and traders. There is not very convenient to trade Chinese stock market on Hong Kong stock exchange.

Trade china stock market using US exchanges

But there is one good alternative. There are plenty of Chinese companies tradable also on US exchanges. These companies list their shares on major US exchanges and these shares could be easily bought and sold. This is another option to trading chinese ETF shares in USA.

How to find chinese companies listed in US

There is one good free stock screener tool that is available for this purpose. The site is FinViz.

So we use a free screener that is available on FinViz site to obtain a list of Chinese stocks listed on major US exchanges.

Use the option Screener from the Main Menu on the FinViz home page and you will see a list of possible parameters that can be set and used for screening purposes.

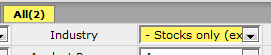

We set Industry to “Stocks only (ex funds).

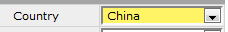

Then we set Country parameter to “China”.

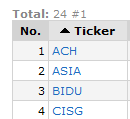

Results are immediately listed on the web page. I have found 215 tickers – 215 Chinese companies traded on US stock exchanges.

How to find best stocks to invest in now

It is good to filter these results further, as several tickers are not suitable for trading or for investment purposes because they could be very risky. Such risky stocks are illiquid and have very low prices – they are more penny stocks.

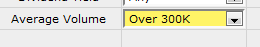

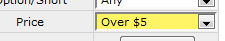

So we implement two more rules in our free market screener. These rules define that the price should be above 5 USD and that average trading volume should be 300,000 shares traded daily as a minimum.

These two parameters could be found on Descriptive Tab of the screener. It is the same page where the first two parameters were found and set.

These parameters decrease the universe of suitable tickers to a much lower number. Now I have a list of only 24 companies from the Chinese stock market. I use the export feature of this free screener to export data to a CSV file that can be imported into my stock analysis software for further analysis.

Fundamental or technical analysis for China’s stock market?

You can also use some fundamental analysis of Chinese stocks although I would prefer to be careful here. Chinese companies are not so well regulated as US or European companies and their management sometimes modifies results and numbers in their books to look better. Even big fund managers like John Paulson have become victim to these practices and lost millions of USD in fundamental investments in some Chinese stocks.

So I would recommend using a shorter term for your activities with the Chinese stock market. Use technical market analysis and use protective stop losses for your trades and active investing.

Find more on related pages

- How to invest in china stock market

- How to trade china stock market index

- Read more about screeners