If you plan to do day trading stock online then you have to develop your own day trading systems that you will use for your trades.

It looks like it is easy to start to generate daytrading profit. It is very easy to find some online broker that opens accounts and provides daytrader software for new intraday traders.

Many wanna-be daytraders started this way without using any daytrading tutorials or training. These traders often made many day trading mistakes that lead to depletion of their accounts. Many of them finished without any money before they were able to learn anything and start profitably day trading stock online.

Key stock trading terms for successful daytrading

Successful day trading stock online activities are based on more than live trades on account opened with an online broker. The most important issue is some form of daytrader training that must be accomplished by every beginner.

There are several forms of such training. Some individuals like to read best daytrading books and learn from them. Others prefer to use some online daytrading courses. The usage of tutorials provided by daytrading training mentors in small groups or individually one-to-one are also very good options.

What should you learn from daytrading training

Any training program should teach you several basics of stock market daytrading. These terms should lead to creation of your own stock daytrading business plan and your own daytrading systems and strategies.

All types of day trading systems should be described by these basics: What market you are going to trade, what is going to be your preferred time frame, how do you enter your trades, when you will exit your trades and how you are going to evaluate the quality of your daytrading systems and strategies.

Basics of stock market intraday systems

It is possible to trade different instruments during a trading day. You have to select your preferred market – stock, currencies or futures. If you select stocks, then it is possible to have fixed list of possible stock market symbols for trading. It is possible to have individual stocks but index ETF shares are also a good option for intraday ETF trades. I recommend using a small set of symbols for daytrading to be able to fully concentrate on following rules.

Time-frame for day trading stock online is also quite important. If you select a short basic time-frame like 3minutes or 5minutes or even 10 minutes then you will find many trading opportunities during a day. This of course could also lead to the daytrading mistakes of over-trading.

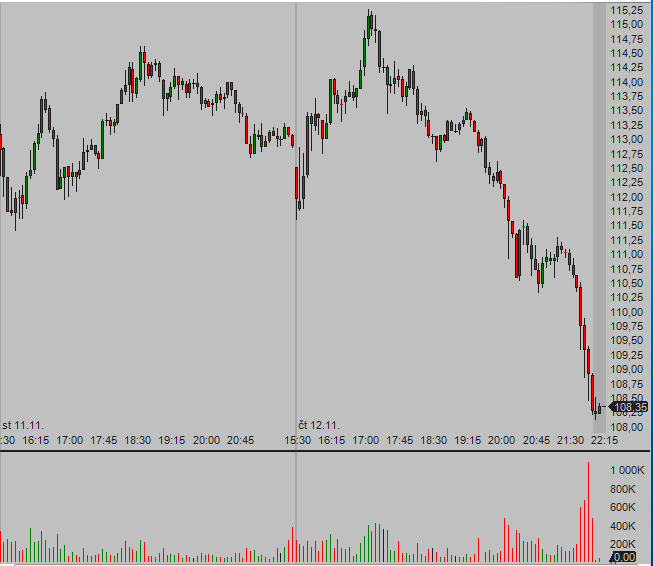

5 min time frame chart

Longer time frames for intraday systems should mean lower frequency of opportunities. These trades will also offer bigger profit potential. There is also different risk management for longer time-frames where you have to achieve more than two to one risk/reward ratio level.

10 min time frame chart

Entries and exits in daytrading systems

The entry rules for daytrading strategies are often based on technical analysis of stock charts. It is possible to trade only simple techniques based on price action and candlestick charts. Or it is possible to use more complex strategies using day trading tools like day trading indicators for momentum, stock market mood, trend movements or reversal points.

Exit rules should cover two basic outcomes of every trade. Stop loss exits and profit taking exits. Stop loss rules should be based on your trade management techniques that uses some form of trailing stop loss level.

Profit taking exits should be defined in advance and used according to these profit taking rules. The defined target based on support and resistance technical analysis is a very good idea. Some form of time-based exit should be incorporated into day trading strategies too. If the trade does not develop for some time or stock market close time is already approaching then it is wise to exit the trade.

Evaluation of day trading systems using accounting software for traders

The final result of a trade is not the only info that should be evaluated. There are more statistics that could be taken from realized trades or from virtual stock trades that should also be done before a real daytrading strategy is finally prepared.

Reports provided by good stock journal software will often show the quality of your strategies. What are the best types of trades, what day trading mistakes are common for you and also what profit you can expect for your day trading system.

Find more on related pages

- Learn to use dia etf for trading

- Find major Nasdaq ETF symbols for stock traders

- Gain more knowledge about profitable daytrading