if you read this then you want to make money trading stocks and become successful day trader. Day trading is a trading style that fits specific personalities. If you fit into this category, then here are tips to help you become a really profitable day trader.

Select the right market for you

If you want to day trade for a living, you have to trade in your comfort zone. You have to select an instrument that fits your personality.

If you accept leverage, then futures is the best product for you. It multiplies price per single contract (i.e. 1 point movement is xx USD).

Volatility is another point to consider. The average price movement per day will show you how suitable the market is for intra-day traders.

These two values are very important. Index futures for the US stock market offer a very different trading environment from crude oil futures or gold futures. And futures for agricultural products are again very different from these groups.

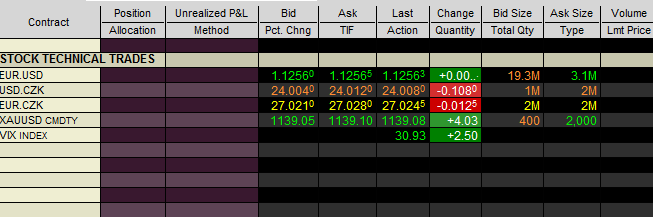

You should also consider the time schedule for your trading. What time slots you have available for your trading decisions and analysis? Is it better for you to trade index futures during the time the stock market is open? Or do you prefer to trade currencies on the forex market since it’s available 24 hours a day?

Study the psychology of trading

It isn’t necessary to have a PhD in psychology, but it’s good to know the basics of emotional control, fear, and greed and what really drives the market price up and down. There are several good books that cover these topics, and you should read some of them.

Master your trading platform

You have to know important features of your trading software. When you will need to execute your day trade, you’ll have no time to check the help files or search menus. You should know all the main steps for the most frequent actions you take. These actions include entering a limit or market order, entering a stop-loss order, change or stop-loss order price level (trailing stop).

Also note the main contacts to get support from the broker you use for day trading. Write it down on paper. Although it can be rare situation, you can experience a power outage or any other problem with your trading platform. If so, you’ll need to contact your broker using an alternative way, not through online channels. So write down your broker’s telephone numbers on paper and place it near your trading computer. And you should have also your telephone available nearby.

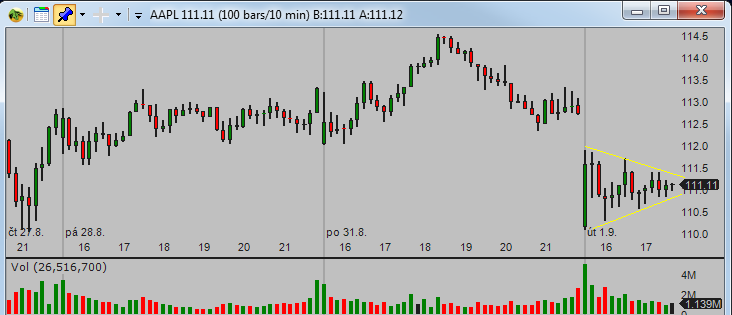

Every successful day trader set the right charts

You’ll base your intra-day trading on a technical analysis. It’s the most common style of day trading. You have to set your charts accordingly to the length of your trades. You can set your main chart with 3-minute, 5-minute candlesticks if you prefer to make quick trades that last only minutes. If your trades last hours, you should set the main chart to 10 or 15 minutes as the base time period for a single candlestick.

Don’t forget to keep your charts simple. You’ll have to make quick analyses and decisions based on your intra-day price action, and you should see clear signals from your charts. Avoid using too many indicators.