Short etf securities are an important group of stocks I use in my ETF trading system. Most of these inverse exchange traded funds are proshares etfs. This is big issuer of leveraged exchange traded funds and short exchange traded funds.

Short selling strategies that I use for my ETF trading with my etf portfolio are created on basic ideas that I use also for trading normal exchange traded funds from all groups available for trading.

The list of etf exchange traded funds I use for my personal trading contains best etfs I have found for my needs of short term swing trading. These inverse etfs are good vehicle for short term trading strategies but they are very risky for position trading strategies and also for long term active investing. I do not recommend to use them for trades that should be developing for weeks or months.

There are many short ETFs available in different groups of etf securities.

- Short etf securities for shorting US markets and sectors

- Short exchange traded funds for shorting bonds

- Short etf securities for shorting foreign markets

- Short ETF stocks for shorting commodities

Stock trading terms I use in my short etf part of etf trading strategy

I do most trades based on an ETF from the first group, which allows me to make a short trade in a sector poised for decline (based on my stock chart analysis).

I use relative strength analysis as my main tool for deciding which sector should be watched as a good candidate for decline. This analysis is key idea behind stock chart analysis of exchange traded funds I do almost every day. This key stock market trading tool I use also in my method for picking best etfs for trading.

This relative strength analysis is done in these two basic steps:

- relative analysis of whole markets, i.e., what is the prevailing stock market trading trend

- analysis of relative performance between a stock market index (like the NASDAQ composite) and a related sector (like semiconductors or the Internet)

When possible candidates for short trade are selected, then I put them in a watchlist. I also use my stock chart analysis principles to find major support and resistance levels and a possible stock chart pattern. Based on these points, I prepare trade setups that are based mostly on a break of some of important support or resistance level or pullback from such levels.

How to analyze Ultra Short ETF for US markets and US sectors

These inverse ETFs are based on major market indexes or Dow Jones sector indexes. I have list of these indexes and chart them in my stock analysis software. Here is the list I have used personally:

$DJUSBM, $DJUSCY, $DJUSEN, $DJUSFN, $DJUSHC, $DJUSIN, $DJUSNC, $DJUSRET, $DJUSTC, $DJUSUT, $DJUSSC, $TRAN, $SPHOME, $DJINET

Another option is simply use standard etf exchange traded funds that represent major sectors and use them as base for sector analysis. When some sector exchange traded funds look well for short trade then it is possible to pick sector specific short etf securities from group of proshares etfs.

Example of technical stock market analysis for relative strength of sectors

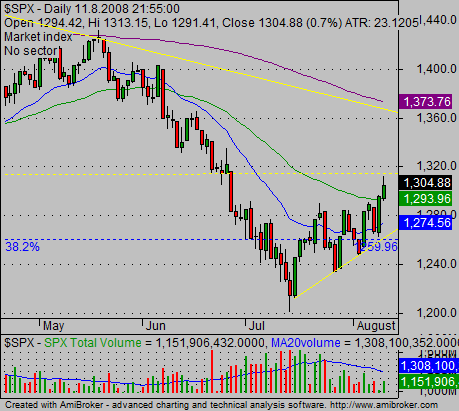

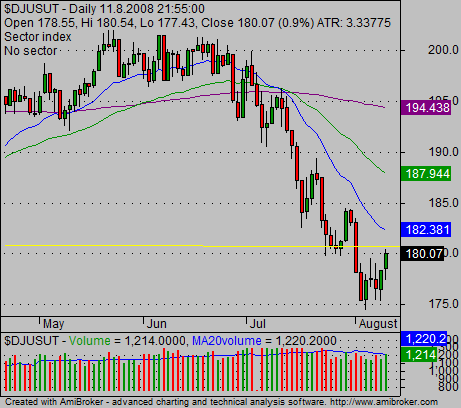

Here is example of a relative strength analysis by comparing of two charts. One is the major market index, the S&P500, and the second is DJUSUT, a utility sector index. You can see the relative weakness of the DJUSUT index against the SPX index in the last 2-3 weeks. So ultra short utility ETFs were worth watching for a possible trade.

There are now quite wide list of possible proshares etfs that are leveraged etf exchange traded funds or short etf exchange traded funds. I personally use them less then standard exchange traded funds for short sell trades. When I want to make short sell trade I prefer to sell short some standard sector exchange traded fund. It is little bit less risky then going long short etf securities.

Find more on related pages

- Understand how to invest in asian stock market using ishares ETF

- Best etfs for dividend and high yield

- Explore more about strategies for etfs