Precious metals commodity ETF shares are one of the best ways to invest in these specific commodities. Especially precious metals exchange traded funds like iShares Gold ETF and ishares Silver ETF – these are heavy traded as they are experiencing big demand from investors around the world.

There are several usable strategies for trading these commodity ETFs. They are typically based on these main ideas:

- Fundamental ideas for holding gold or silver long term

- Momentum strategies, as these precious metals exchange traded funds are experiencing strong trending moves

- Gold/Silver ratio trading strategy

Fundamental ETF trading strategy for Gold and Silver ETF

I am not a big fan of holding onto commodities for the long-term using a buy-and-hold style of investing. I do think that commodities are not the best way to invest for the long-term. Stocks and bonds offer much better long-term investment opportunity than commodities. And gold and silver especially are commodities which are not very much usable. They are only being bought as an inflation hedge. But this idea is not confirmed by history.

This does not mean that it is not wise to hold some gold or silver in your portfolio. It’s just that the holding period should be much shorter then decades or so.

It is necessary to implement a more active approach to commodity ETF investing. It is very profitable to participate in strong trend moves in precious metals ETFs when they occur. They can be up or down.

You can check some trading strategies described below.

Momentum strategy based on trend analysis

Commodities can ride very strong trend moves. They can go up a lot and can also go down a lot. You can see examples of these trends on charts of the iShares ETF for gold and silver.

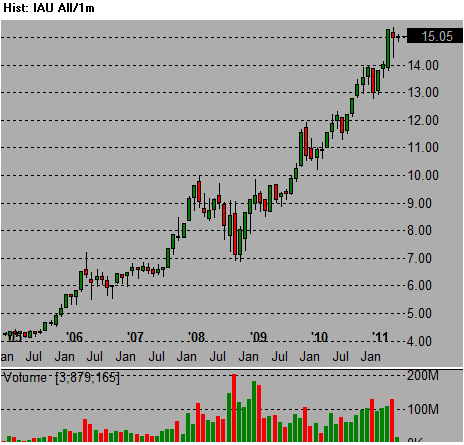

iShares Gold ETF long-term stock chart

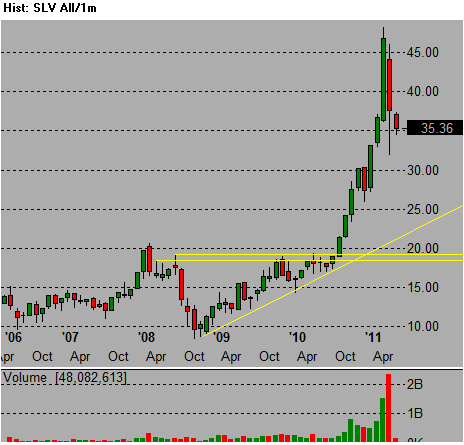

iShares silver ETF long-term stock chart

There were entries for mid-term orientated investors/traders, too. Position trades with long iShares Gold ETF IAU could be entered in 2007, when it broke to a new high above 7 and then in 2009 when it broke above 10.

It was also possible to reentry trades in pullbacks to these levels. This breakout and pullback strategy is a powerful strategy for trending commodity markets.

Gold/Silver ratio strategy

This strategy expects that gold and silver trade long-term in a defined range. As you can see on the chart of this ratio, the typical range extremes are 46 and 60.

This commodity strategy is usable in situations when these extremes are breached and the ratio is moving far from them. As you can see on the chart it was the end of 2008 and then in mid 2011 .

This strategy expects that these extremes are not sustainable and that the ratio will return to a typical trading range. So it is worth it to trade this commodity ratio accordingly. In 2008 it was shorting the gold ETF and going long on the silver ETF and in 2011 by shorting the silver ETF and going long on the gold ETF.

I personally traded this commodity strategy on my account and used my Global macro research notes as background for this trading idea.

As a as final note I would like to mention the possibility to trade directly some gold related stocks like gold mining companies. These commodity related stocks could also be used in several different stock trading strategies.

Find more on related pages

- Are gold bullion securities good stocks to invest in?

- Learn to use Palladium and Platinum ETF

- Read more about the best ways to invest money