Broker, Investment, Stock selection. These three main topics can often be found in any online stock trading forum. Investors and stock traders like to discuss these points, as they think that they are the most important issues for successful traders or investors.

Are they really so critical? Well I think that the most important part of this business is the equity market business plan. Every trader or investor has to understand that stock trading must be taken seriously and must be done in a business manner. This means that a business plan should exist in written form.

Such a plan should also discuss these themes: broker investment stock selection. But not only this. It must contain much more. Starting with a definition of your vision and goals and finishing with details of your different strategies you want to use in your equity market system. So let’s take a look at details of broker investment stock selection sections in any trader’s business plan.

Best broker for stock trade ideas

Opening a brokerage account is the easiest part of this business. It is very easy to find an online broker, fill out the forms online or in written form, then scan them and send back to your broker by email. After some review, the broker opens your account and provides instructions on how to send money. Then the trader or investor sends money to the account and is ready to trade.

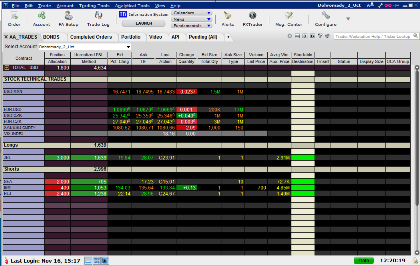

Stock broker software

As you can see it is a very easy process. Most wanna-be traders and investors start with this. But this is mistake. This process of selecting the best broker and opening an account with some top broker should be one of final parts after understanding and learning stock market investing. After proper preparation of a business plan, after testing several ETF strategies and understanding their pros and cons.

But when you have already prepared and tested several different strategies for different equity market situations, you can select the best broker for your needs. There are plenty of online brokers, some of them are deep discount brokers.

It is also normal that one top stock broker is not the best broker for another trader or investor. Two different traders can have different needs. The top broker for a daytrader could offer different features than the best broker for a swing or position ETF trader.

The most critical issue I want to stress is: Do not look for free online trade feature. Do not prefer smallest commissions and brokerage fees.

They are important, right. But there are also several other features to be put in the mix for selecting the best broker for your specific type of trading or investing. And I think you understand that nothing is free of charge. Any broker offering a free online trade feature will take your money somewhere else.

I prefer to deal with a fair offer of good commissions combined with other important features I want to have.

So make a proper business plan description of broker investment stock selection sections.

My best stock market investment tips

The second important issue from broker investment stock selection sections is discussion of investment time frame.

Most people think about investing only for the long term. But I would like to tell you one truth. We are now living in a much different environment than 20 years ago. It was fine to be a buy-and-hold investor in 1980s or 1990s. But since 2000 we are in very range bound long term market situation which is not good for buy-and-hold investors. My best stock market investment tip for any long term investor is – do not expect to make money by buying and holding for long time. Prefer to be a more active investor. Define your trading and investment strategy to be able to make money by holding positions open for several weeks or a few months only.

Active investing or stock or ETF trading could also provide you much better risk management for your money. Risk management rules must be an integral part of any good equity market business plan. Do not expect that any law or government oversight is able to protect you and your money. You must do it yourself.

Stock selection process

This is also a must-have point of broker investment stock selection sections in your plan.

This part of your trading plan should cover details about how you find the best equity market opportunities. These ideas and opportunities should be the best ones. They have to generate money when they are traded accordingly with your strategies and system rules.

Good stock pick selection example

It is possible to have several ways to find the best opportunities. The first one is to have an already predefined list of stocks you want to analyze and trade. It is something like my list of ETFs I monitor and analyze every day.

The second possible way is to use some best market screeners. These screeners should help you find a short list of possible trading candidates based on your parameters. These rules can be fundamental or technically based. Remember: You can have fundamental backing for your ideas. But fundamentals will not help you to make money over a shorter time period of time.

Technical market analysis and rules for reading of price charts will help you not only prepare the best setup for a trade, but also to define risk parameters. And finally technical analysis of the equity market will help you to manage your trade to squeeze as much profit as is possible.

Find more on related pages

- Inspire how to find the best stocks to invest in

- Master three parts of stock market education

- Explore further best ways to invest money