Active investors often look for best ETFs that could be used in some dividend based or high-yield based stock investment strategy. Such income stock investing strategies are quite common. And it is OK, as dividends played an important role in total returns from stock market investments during previous decades.

And it looks like dividend income is going to play an important role in future years too. The world’s major central banks slashed official base rates to a minimum and the de-leveraging period will assure that they stay there for longer time than expected – just look at Japan as an example.

The ability to find best stocks to invest in or best ETFs that could provide good dividend income will play an important role in any strategy for stock investing. PowerShares offer a list of best etfs for this purpose.

Three groups of powershares funds for dividend and yield etf investing

Invesco PowerShares Capital Management LLC company creates many different exchange traded funds. These ETFs offer many different way to create a profitable strategy for stock investing.

There are also three groups of etfs that could be used for dividend and yield based investment strategies. These etfs can be found in Equity Income group, Fixed Income group and Hybrid group.

Equity income funds

This group offers five funds. Buyback Achiever Portfolio (Fund) with symbol PKW tracks the index of companies with share buyback activities during last trailing 12 months.

The Dividend AchieversTM Portfolio (Fund) creates its own portfolio based on companies that pay dividends and increase dividend payments. Its market symbol is PFM.

The High Yield Equity Dividend Achievers Portfolio (Fund) tracks 50 stocks offering nice dividend and also dividend growth. Its market symbol is PEY.

The last two additions to this group are KBW High Dividend Yield Financial Portfolio fund with symbol KBWD and KBW Premium Yield Equity REIT Portfolio fund with ticker KBWY

Fixed income funds

These etfs track different bonds group. There is a treasury fund tracking US Treasury issues named 1-30 Laddered Treasury Fund with symbol PLW. There are also several municipal bond funds like Insured National Municipal Bond Portfolio , symbol PZA or Insured California Municipal Bond Portfolio symbol PWZ that hold municipal debt.

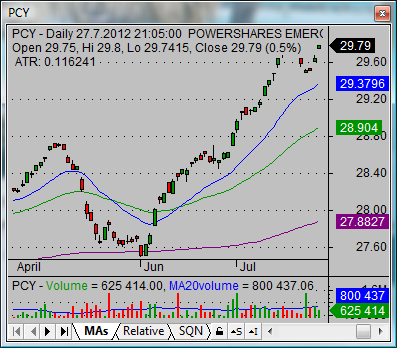

There is also a specific Chinese Yuan Dim Sum Bond Portfolio investing in issues denominated in Chinese Yuan currency. The market symbol for this etf is DSUM. Broad emerging market bonds could be found in Emerging Markets Sovereign Debt Fund, with symbol PCY

Corporate area is covered by Fundamental High Yield® Corporate Bond fund, symbol PHB and by Fundamental Investment Grade Corporate Bond fund with ticker PFIG

Hybrid powershares funds

This group consists of very specific and special exchange traded funds. There is CEF Income Composite Fund with ticker PCEF. It is a fund of funds investing in investment grade fixed-income securities.

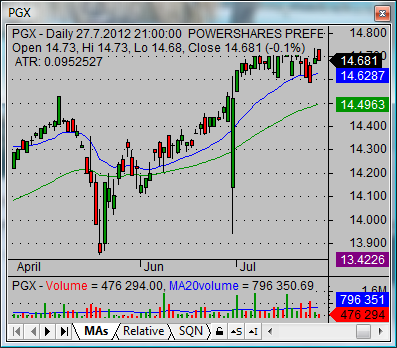

Preferred ETF with ticker PGX invests in accordance with the index tracking fixed rate U.S. dollar denominated preferred securities issued in the U.S. domestic market.

Finally there is also Convertible Securities Portfolio available with ticker CVRT. The fund invests in U.S. dollar-denominated investment grade and non-investment grade convertible securities sold in the U.S. market and publicly traded in the United States.

Best etfs for your investment strategies

The selection of the best stock to invest is based on your individual etf investing strategy. Powershares offer quite a wide list of ETFs. Prepare your strategy for stock investing based on dividends or yield in advance. And then select the best etfs accordingly.

The last stock market investing advice: Define your rules and follow your rules. Stock market investing plan is a key.

Find more on related pages

- Check also Reit ETF ishares funds

- Understand how to analyze and trade Dow Jones utility average

- Test also other good ways to invest money