PowerShares etf trading strategy

Investing or trading with agriculture ETF shares could offer another approach for commodity ETF Investing or trading strategies. Food and agriculture commodities are quite hot as demand from emerging countries, especially in Asia is growing.

This means that investors are interested in buying and selling of agriculture ETF shares. And it produces tradable trend moves which can also be used by short and mid-term traders who (like me) prefer to hold these shares for a relatively short period of time.

Agriculture commodity fund shares for your watch list

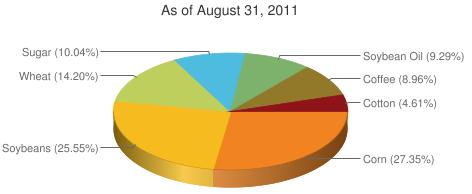

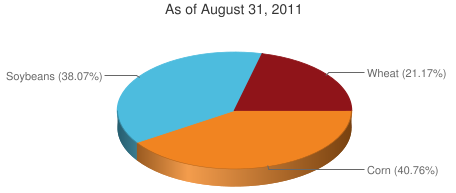

I personally put DBA PowerShares DB Agriculture Fund into my list of ETFs I monitor for possible trading opportunities. This exchange traded fund monitors performance of major agriculture commodities. Base weight (as dated 09/2011) for this fund is described in this table.

I personally put DBA PowerShares DB Agriculture Fund into my list of ETFs I monitor for possible trading opportunities. This exchange traded fund monitors performance of major agriculture commodities. Base weight (as dated 09/2011) for this fund is described in this table.

Another option for traders and active investors for agriculture investments is JJA – iPath Dow Jones AIG-Agriculture ETN. This fund reflects the returns that are potentially available through an unleveraged investment in the futures contracts on physical commodities comprising the Index. The Index is currently composed of seven futures contracts on agricultural commodities traded on U.S. exchanges.

Specific sub-sector agriculture funds

If you prefer to use only very specific agri commodities then it is possible to trade these agri sub-sectors.

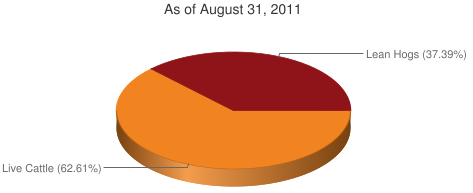

iPath Dow Jones-UBS Livestock Subindex Total Return – COW covers prices of Lean Hogs and Live Cattle only.

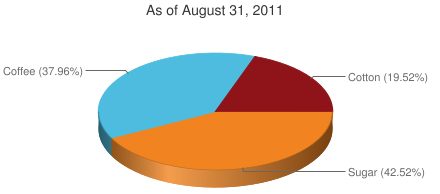

iPath Dow Jones-UBS Softs Subindex Total Return – JJS covers only soft agri commodities like cofee, cotton and sugar.

iPath Dow Jones-UBS Grains Subindex Total Return – JJG covers only grains commodities like soybeans, wheat and corn

ETF Trading strategy for agricultural fund shares

As you can see, it is possible to divide total agriculture sector into very specific sub-sectors. This means that you can easily compare shares of all agriculture exchange traded funds mentioned above with broad-based agri commodity ETFs like DBA or JJA.

Then you can use the principle of relative strength analysis and find best stock pick for long trade and best stock pick for short trade. As you can see on the charts above, the current situation in Agri commodities is not very bullish. It is better to look for a short sell etf pick and the best candidate is probably JJG.

Find more on related pages

- Best gold stocks, gold miners & gold etf

- How can copper prices affect stock market online trading

- Read more about commodity ETFs